Search results

170 results found.

MarkFord.net

MarkFord.net

The open-for-inspection half-way home for my writing…

170 results found.

Every time I take a walk around a company that I’m working with and talk to employees I hardly know, I discover something interesting about the business. As often as not, that something is a problem.

Some of the problems are small. Some are serious. Many of them are years old. What’s shocking is that they almost always come as a surprise to the CEO.

On a recent walk around, for example, I discovered that there was a glitch in the way orders were processed. (And we’re talking thousands of orders every day.) Not only was it causing week-long fulfillment delays, a shocking number of orders were simply dropping out of the system.

Since the problem had developed over a long period of time, the decrease in revenues looked like a gradual decline in sales that upper management was attributing to a weak market.

After alerting the CEO to the problem, it was solved in less than a month. But during the investigation, it was discovered that at least half a dozen line workers had tried to contact management about it. Somehow, their concerns never reached anyone that paid any attention. I would estimate that the total loss in revenues had been millions and millions of dollars.

I discovered a less-dramatic example earlier this week. When the receptionist in one of the company’s buildings has to leave her desk, she asks the people in the mail room to back her up. But the people in the mail room can’t always hear the doorbell ring. So if you ring the bell when the receptionist is gone (as I did), you are likely to stand there for a very long time.

This isn’t the sort of problem that can (usually) stop your business cold or whose cost can be calculated in dollars. But it can damage your business in small but significant degrees. (In this case, if you consider the fact that it was going on in the building that houses the company’s top brass, you can imagine the impression it was having on VIPs that came by for appointments or meetings.)

Many senior executives I know pride themselves on being “big picture” people. They rely on subordinates to identify problems and solve them. Or at least bring them to their attention if an easy solution isn’t available. That only increases the risk that such problems will arise all over the place and go unnoticed for who knows how long.

When you’re at the top, it may feel like everything is going smoothly. But down below, there could be dozens or even hundreds of flawed processes and protocols that are eating away at your business like termites in a wooden building.

This should not be a new idea to anyone with even limited experience in management. Experts call it “incremental degradation.” It’s a term that’s usually used to describe the process of gradually degrading product quality by chipping away at production costs. However, entropy operates at every level and in every part of every business: customer service, production, fulfillment. Even sales and marketing.

Business termites are a fact of life. And unfortunately, there is no sure-fire, one-step way to identify and exterminate them. But there are several things you can do to keep them to a minimum.

I asked Bismarck, the resident director of FunLimon, our family’s community center in Nicaragua, how that “whacky solar power experiment” was going.

He said the panels and related equipment were installed and that the system had been active for nearly two weeks.

“Do we know how well it’s doing?” I asked. “Like how much of FunLimon’s energy it’s going to be supplying?”

“I just got a report from Alan V,” he replied. (Alan V is Rancho Santana’s chief engineer.) “He said that it will be supplying all of it.”

“All of it? Really?”

My longstanding impression of solar energy was that it was costly and inefficient. I knew that progress was being made. But I never expected that these panels, located on top of the roof that covers the basketball court, would be sufficient to power the classrooms, administration buildings, gymnasium, and irrigation system.

Bismarck and I went over the numbers…

It cost $45,000 to install the solar system, including the panels and the batteries and all the equipment. We’ve been spending about $800 a month on electricity at FunLimon. So if the system does indeed provide all the energy we need, the payback will take about five years. After that, the cost of our power will be de minimus– only what it takes to maintain the equipment.

I contacted Alan directly, and he reminded me that the system he had installed a year earlier was now powering most of our company’s buildings at Rancho Santana, including the hotel, clubhouse, restaurant, and a dozen related structures.

I did more research. And it turns out that solar power has come a long way from its crude beginnings 40-odd years ago. Back then, it was, as is often the case with new technology, not just inefficient but very costly. So costly that many predicted it could never compete with fossil fuels. It took almost 30 years to bring the cost down to $8 per watt in 2010. Today, it’s dropped, on average, to about $3 per watt, with some systems producing energy at half that cost.

This astonishing reduction is the result of making solar panels more efficient while, at the same time, reducing their costs. A parallel advancement was made with the batteries that store the energy produced by solar panels.

I saw a PraegerU presentation recently that argued against the effort towards alternative fuels. Fossil fuels, it said, provide 99% of the energy in the world today, and that percentage will not drop by more than a point or two over the next 50 years.

But based on what we are actually experiencing in Nicaragua, I find that hard to believe. If solar panels can pay for themselves in five years at FunLimon and at Rancho Santana, why can’t they do the same for millions of businesses all over the world?

If you are interested in an explanation of our system, you may find the following edifying:

The attached picture is a screenshot of the solar system application at 9:25 a.m., local time.

As you can see on this picture attached the icon means as below:

1) The solar panels are producing 6.91 kw at this time and delivering that power to the facility (FunLimon), see the upper left icon at the screen.

2) The facility is demanding or consuming 10.39 kw of power at this time, see the icon at the center of the screen.

3) The public power company is supplying 0.05 kw, see the icon at the right side of the screen.

4) In order to minimize the utility power consumption, the solar system is providing 3.43 kw to the facility from the battery (see the lower left icon at the screen, the battery charge state at this time is 22%) at this time to compensate for the demand, so if we add 6.91 kw from the panels and 3.43 kw from the battery we get 10.34 kw plus 0.05 kw from the utility power company for a total of 10.39 kw (see item 2).

In other words, right now (at the time of the screen shot) FunLimon is only using 0.05 kw out of total power consumption of 10.39 kw from the public grid, that is only 0.48%. The system is very dynamic and it changes slightly about every 5 seconds as the sun’s intensity and power demand varies….

The protocol is that when the solar panels are producing less than the power demand, the system uses the battery charge to compensate and minimize the use of the public grid. When the solar panels produce more than the power demand the system takes that excess of power and starts charging the battery. The idea is that at the end of the day on a normal sunny day the power consumption during the day from the public grid is going to be minimum and the battery state of charge is going to be 100% to be used at night until it gets 90% discharge….

One of the most commonly debated topics in direct marketing is how much and how often one should market to a customer or potential customer. The most common answer is: Enough to make sales but not so much as to become annoying.

This is not true. More importantly, it is the wrong question.

Like every other semi-science, direct marketing is awash with “proven facts” that are bogus. One of these is that information publishers should give their customers at least as much non-promotional education as advertising.

You can find studies that support this position, but they are almost always small and specific. And that means they are unreliable.

I was once in love with marketing “rules” and tested every one that appealed to me. What I found out after thousands of tests to millions of customers was that there are very few rules that you can rely on. And even those, you cannot rely on 100%. But one of the rules I believe you can trust is that there is no limit to how often you should market to your customers.

For some, this defies logic. Advertisements are inherently annoying, their thinking goes. So if you want to have good relationships with your customers, go easy.

There is a simple fact that undermines their reasoning: The average American consumer sees more than 500 ads a day. (That number must include billboards and radio and television ads, as well as every internet ad that pops into view.) The number of ads that they actually notice might be 20% of that… but it’s still 100 a day!

Think about that. And let me ask you this: How many of the ads that you see every day do you remember? READ MORE

My first real job was as “backseat wiper man” at the Rockville Center Car Wash on Long Island. I was 14 and happy with the $1.25 an hour they paid me. A couple of years later, when I had a summer job as a housepainter’s assistant in swank Hewlett Bay Harbor, I became an “entrepreneur.”

What happened was this. My friend Peter and I were scraping the shingles on a big yellow house when the lady of the house, a Mrs. Bernstein, came out and asked for Armando, our boss. Armando’s routine was to drop us off at the work site at 7:00 a.m. and disappear until 5 or 6 in the evening.

We were left to do the work, with virtually no experience and only Armando’s advice on watering down the paint and “dry rolling” the second coat to guide us. (Dry rolling is when your painter pretends to be giving you a second coat when, in fact, his roller is dry. This allows him to get the job done twice as fast and save a bundle on the cost of paint.)

“I’m onto your boss, Mrs. Bernstein said. “How much does that cheap bastard pay you?” We told her. She harrumphed and disappeared inside. When she came out, she announced, “I just fired that good-for-nothing. But if you know what’s good for you, you’ll be here Monday morning. I’ll pay you an extra dollar an hour to finish this job properly.”

The point of this little story is to illustrate how I accidentally started working for myself. (Some other time, I’ll tell you what happened when Armando discovered our duplicity.)

I just fell into it. And I loved it. I although I didn’t stay in the painting business very long, the experience of having my own business became a habit that continued, with a few brief exceptions, for the rest of my life.

The stories that are told about entrepreneurs are about men and women with dreams. People who imagine building and selling better mousetraps, who risk all their money and time to make those dreams come true.

My story is not nearly as dramatic. And that’s probably why it’s seldom told. But it’s not a bad way to begin.

What Peter and I did, unwittingly, was to start a business by “knocking off” the business we worked for.

And this is not a terrible idea. (Well, that depends on how you do it.) In fact, it’s probably the easiest and surest way to become an entrepreneur. And I’ll bet it’s the most common way as well. Way more common than having the dream.

Last week, I suggested that it takes more than an idea – even if it’s a really fantastic idea – to attract potential investors. You need to prove that your idea has legs by turning it into a working model.

But then what? Once you’ve got a working model, where do you go for the money you need to turn it into a business?

In general, there are four sources of capital: venture capital firms, government agencies, commercial banks, and private investors or partners.

If you think your idea might be of interest to venture capitalists, check out the National Venture Capital Association (nvca.org). But for the average entrepreneur, venture capital isn’t a possibility.

As Paul Lawrence explained in his article “Raising Capital for Small Business Ventures”:

Yes, some venture capital firms will invest in new businesses, but such businesses are usually involved in technology or some other high-growth area. Frankly, for most small businesses, venture capital isn’t even an option. It’s rare for a small-business concept to have the kind of mammoth payoff venture capitalists look for.”

Plus, the cost of doing business with these companies is high. It’s basic economics. Their risk is high, so their reward must also be high. Even if you were to interest a venture capital company in your business, you’d be aghast at what they’d want in terms of their ownership position.

What about government grants? Tim Berry, author of Hurdle: The Book on Business Planning, points out that government funding agencies usually have “social” agendas. Grants and loans are available to minorities – especially minority businesses engaged in education, antidiscrimination projects, community services, fine arts, and other politically popular objectives.You can find out if your business idea might be a candidate for government money by checking into any of the government agencies whose purpose is to stimulate entrepreneurship. The best known is the Small Business Administration.

I wouldn’t advise taking this route, though. It requires too much bending to bureaucracy. Too much artificiality. Too much red tape. Getting these loans and grants takes months (or years) of filling out forms. And there are all sorts of reporting and regulatory requirements – enough to slow down even the most patient person. Plus, government-funded business projects have an extremely high failure rate once the funding is withdrawn. That’s because they begin with an idea, not a working model. And the idea isn’t good to begin with because it is based on social policy instead of being connected to profits – which is, after all, what fuels a business.

As for getting money from a commercial bank, I can make this short: Forget about it. The only way a bank will lend you money these days is if (a) you have excellent credit and (b) you can collateralize your loan with assets. If you have good credit and tons of money, you don’t need a bank loan. You can loan yourself the money.

This brings us to the fourth and final option…

“I come from a poor family. I want to start a business and make money to help them. But when I see successful businesspeople depicted on TV and in the movies, it seems like lying and cheating and screwing people is the way to go. I’m worried. Is that what I’m going to have to do?”

“I come from a poor family. I want to start a business and make money to help them. But when I see successful businesspeople depicted on TV and in the movies, it seems like lying and cheating and screwing people is the way to go. I’m worried. Is that what I’m going to have to do?”

This question was posed just after I had given a presentation on entrepreneurship to a group of MBA candidates at Florida Atlantic University. I was momentarily startled by it. I was sure I hadn’t said anything that suggested success in business requires a cutthroat approach.

Still, the question was understandable. When Hollywood shows us business and businesspeople, it is more often than not in a negative light. And when Wall Street, the banking community, and the insurance industry screw their clients – as they’ve done so notoriously – how could any young person think differently?

So I told the young people in my audience what I’m about to tell you.

Re my productivity system:

“I love [your productivity system]. I still use it. With some modifications of my own. Would be so helpful to me and others, I think, to see how you’ve modified this to consistently get so much done.” – ND

My response: I’ve written several essays on my time management system as I’ve developed it over the years. And I intend to keep writing about it. Meanwhile, if you don’t already have them, you might want to get a copy of Wealth Planning for Freelancers and/or Making the Most of Your Time. These two books are in limited supply. For availability, contact us.

Re the availability of my books:

“Please let me know how I can secure copies of your books.” – DWS

My response: Most of my books are available on Amazon. You can access them directly on this website by clicking “My Books” in the menu in the upper-left corner of the Home page.

“Maybe all one can do is hope to end up with the right regrets.” – Arthur Miller

20 Things You Don’t Know About Me

(That I May Regret Telling You)

I’m not going to tell you all 20 today. I don’t have time and you don’t either. I’ll talk about three of them, and – if this doesn’t turn out to be a huge mistake – I’ll l send a few more in the upcoming weeks.

I played a transvestite prostitute in a Herschel Gordon Lewis movie. Yes, that’s me looking like Phyllis Diller on steroids. When I saw myself on film, I was shocked and dismayed. For some reason, I’d always imagined I would make a better looking woman. But Herschel liked the look. Of course, he is the Godfather of Gore and the legendary auteur behind some of the most famously bad movies of the 1970s.

I knew Herschel as a copywriter during the 1990s. He did some work for me. He was a competent, experienced professional. Easy to work with. That’s all I knew about him until my neighbor, Roger, who was a film critic, was telling me about this guy he knew, Herschel Gordon Lewis, a famous filmmaker of the 1970s. I said, “That’s funny. We have a well-known copywriter in our industry with the same name!”

When I realized it was the same guy – and that not only did he have these two very different careers, he was also a respected journalist, a competent piano player, and generally erudite – I decided to make a documentary about him. He agreed, but only if I would produce another movie he’d had in the back of his head for many years. It was called “The Uh Oh!” He wrote and directed it. I co-produced and made this cameo appearance. The movie went on to win many horror film festival awards. Nothing was said about my performance.

2. Repeat Offender

I’ve been arrested at least a half-dozen times. The first time I can remember was in 1969.

RR (a high school friend) and I had set off for Woodstock in a car that a guy that worked for RR’s dad had lent us. But then we decided – I can’t remember why – that Woodstock wasn’t going to be all that much fun, so we turned west and set off for California. We had a tent, some camping equipment, and some “mood enhancers” that RR had brought to enhance our experience, and we had many what-seemed-to-be brilliant conversations along the way.

Many of those conversations were about war, government, and politics. (Vietnam was in full throttle then.) And some were more esoteric – such as the electro-physiological explanation we came up with for déjà vu. (A nanosecond short circuit in the brain’s short-term memory wiring.)

We were at a rest stop in Texas when a cop car pulled up behind us. At the time, I knew that being in possession of pot in Texas could get you a life sentence, so I was gearing up to confess and throw myself on their mercy. In the rear-view mirror, I could see that one of the cops was on his walkie-talkie. Then he put it down, came over to our car, gestured for RR to roll down his window… and apologized. “Sorry,” he said. “You guys matched the description of two armed robbers we were looking for.”

He got back in his car and they sped off.

We drove very carefully out of Texas, scrupulously observing the speed limit, and finally reached California. Exhausted, we decided to pull off the highway to take a nap. I scrunched down in my seat, put my feet out the window, and passed out. Next thing I knew, a highway patrolman was tugging on my shoes. He asked RR for his license and registration. RR handed them over.

“This registration is expired,” said the patrolman.

“I didn’t know,” said RR.

“In fact,” said the patrolman, “it expired 3 years ago.”

He paused. “Where did you get this car?”

I looked at RR. He shrugged his shoulders.

The patrolman asked us to step out of the car, and he started rummaging through it. He found the pot in RR’s bag.

He escorted us to the nearest police station, where we were locked up in a holding cell. We were charged with grand theft auto and possession. Our bail was set at $5000. RR’s father bailed him out the next morning. And although my parents could have scraped up the money to cover my bail, they decided a bit of time in a jail cell would edify me.

I stayed there a week. By that time, the grand theft charge had been dropped. The judge fined RR $600 for possession, and fined me $250 ($50 off for each day I had spent in jail).

I could tell you a few grim stories about what I witnessed and experienced that week, but I won’t do that today. What I will say is that – for me – the worst thing about being in jail was not the tight quarters, hard bed, bad food, threats, intimidation, and occasional brutality, but the fact that I could not just get up and walk out the door. You will never know the amazing value of freedom until you’ve been locked up in jail.

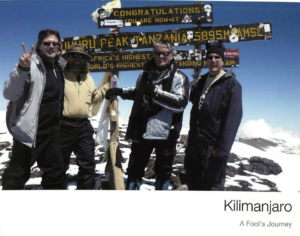

I climbed Mount Kilimanjaro.

For several years, my friend and client Dr. Al Sears had been encouraging me to climb a mountain with him. He was very much into mountaineering at the time, and had been making his way through a series of tall mountains out west.

I had no interest in climbing and was too busy anyway. But I felt guilty saying no over and over again. And so, when he invited me to climb Mt. Kilimanjaro in February of 2010, I agreed, thinking that something would surely happen before then that would make the adventure impossible.

Alas, divine intervention never occurred. And I found myself in Moshi, Tanzania after flying for a total of 17 hours. Our team consisted of Dr. Al, our fearless leader and expert climber; Daryl, the tech expert; Kevin, my childhood friend and one of the funniest most tenacious people I know; and yours truly.

We checked into our hotel (which looked a lot like a military compound) and rested up. We would head for the mountain the following morning.

I woke up with what felt like symptoms of bronchitis, but pressed on to rendezvous with the team and our guide, Raymond, in the lobby. After sorting out a minor miscommunication over weight limits for our gear, we were off. A harrowing bus ride and several warning signs later, we got off the decrepit vehicle and began our climb.

What followed was a five-day ordeal that I can only describe as hellish, painful, unbearable, and insane. Every day was worse and more arduous than the last. I eventually found myself just putting one foot in front of the other while mentally reciting my mantra that it would eventually be over.

My bronchitis worsened and Raymond’s oxygen testing device made it clear that I had pushed myself to the point of concern, but I stubbornly pushed on, pretty much running on fumes. Finally, Raymond put his hand on my shoulder and motioned for me to look ahead. There it was. Uhuru Peak. We had conquered Mount Kilimanjaro.

I staggered to Kibo Hut, a campsite along the mountain route, walked past the table of food laid out for us, and crawled into my cot. Dr. Al checked me out and called for a stretcher.

An hour later, I was on the stretcher, bidding my friend’s adieu. I was smiling. Daryl and Kevin looked envious. Being toted on a stretcher supported by a bicycle wheel was not comfortable, but I was half-delirious and happy to be off my feet. I met up with my buddies at the next stop down, and we all had a good sleep. The next morning, I felt much better and completed the descent with them on foot.

I will say this about climbing Mount Kilimanjaro: If there is a better way to test the limits of your endurance, I don’t know it. I’m glad I did it and will be proud that I did it for the rest of my life. But would I do it again? NO!

This essay and others are available for syndication.

Contact Us for more information.

“An optimist is a person who starts a new diet on Thanksgiving Day.” – Irv Kupcinet

What You Probably Didn’t Know About Thanksgiving

Some interesting things to ponder while enjoying your leftovers…

Backflow Friday

You know that Black Friday is a particularly hectic day for retail workers, but you may not know about another heavily affected industry – plumbing. According to Roto-Rooter, the Friday after Thanksgiving is their busiest day of the year. They attribute this to two things: (1) mishandled grease that finds its way into drains and garbage disposals and causes clogs, and (2) large gatherings of people that lead to bathroom overuse that stresses the system.

Same Old, Same Old… Only Different

Whether it’s for actual viewing or pleasant background noise, about 50 million Americans tune in to the annual Macy’s Thanksgiving Day Parade – an extravaganza that is estimated to cost between $11 million and $13 million each year. Another 3.5 million people usually brave the New York cold to watch it in person – some arriving as early as 6 am to get a good spot along the parade route, But this year, that’s not what happened. The only way to watch the parade was on TV. Yes, it had balloons and floats and celebrities and musical/theatrical performances, but (to avoid drawing crowds) there was no “parade route.” The action was centered around the Macy’s store at Herald Square, and much of it was pre-filmed.

The Great Balloon Massacre

Speaking of the Macy’s parade…

Originally, there was no limit to the size of the balloons in the parade – and they grew and grew. Strict regulations were put in place after strong winds damaged or demolished about 20 of the balloons in the 1997 event. The Pink Panther (one of the balloons that was subsequently banned from making future appearances) kept knocking over its handlers and had to be stabbed by the police to bring it down. Barney the Dinosaur flattened a tree, went out of control at 51st Street, and had to be stomped to death. And the Cat in The Hat – in what has been described as the worst accident in parade history – broke into the crowd, injuring 4 people, including one who was in a coma for a month.

Dutch Courage?

The commonly spouted Thanksgiving “story” is that the pilgrims fled England to escape religious persecution. The truth is, they embarked on their journey from the highly tolerant country of Holland, where they had been living free from religious persecution (and the Church of England). Their mission was to remove their progeny from the materialism of Dutch culture and establish an ideal Christian commonwealth.

No Harm, [Probably] No Fowl

Another common narrative is that the pilgrims ended up oppressing and destroying the indigenous people whose settlement they stole upon arrival in 1621. In reality, the pilgrims came upon a nearly empty settlement that had already been destroyed by disease. One of the settlement’s survivors, Tisquantum (Squanto), would ultimately help the settlers cultivate crops and negotiate trades with the local Wampanoag chief Massasoit. Pilgrim governor William Bradford would even go on to call Squanto a “special instrument sent of God.” Their “Thanksgiving” was a three-day event (inspired by the Biblical holiday of Sukkot) celebrated by the settlers and Wampanoag, one that historians believe likely didn’t have turkey on the menu.

The First First Thanksgiving

Speaking of the first Thanksgiving…

Some historians tell us that the first Thanksgiving actually took place in Florida more than 50 years before the pilgrims got here. It happened on September 8, 1565 in St. Augustine – the day the Spanish settlers that founded the city came onshore, celebrated with a Thanksgiving Mass, and shared a meal with members of the local Seloy tribe. The food likely consisted of provisions that the settlers had brought with them on their ship (salted pork, garbanzo beans, hard biscuits, and wine), along with whatever the Seloy may have contributed (venison, tortoise, squash, fish… and maybe turkey).

Holy-Day? No Way!

On October 3, 1789, George Washington signed a proclamation designating Thursday, November 26 as a national day of thanks. But the proclamation was good only for that year. John Adams and James Madison, too, signed one-year-only proclamations. (Thomas Jefferson notably refused to acknowledge the day because he believed the religious connotations to be a direct violation of the First Amendment.) From then on, it was left up to the individual states. It wasn’t until 1863, when Abraham Lincoln proclaimed the last Thursday of November to be “a Day of Thanksgiving and Praise,” that it officially become an annual federal holiday.

The So-Called “Mother of Thanksgiving”

So who do we have to thank for Lincoln’s decision to make Thanksgiving a national holiday? Sarah Hale gets the credit, as she spent almost 40 years campaigning for it until she finally won over the president. As part of her campaign, Hale, the editor of Godey’s Lady’s Book, promoted the idea to her readers by publishing Thanksgiving-themed stories and poems and recipes for such things as roast turkey and pumpkin pie. (By the way, she is also credited with writing the poem that became the nursery rhyme “Mary Had a Little Lamb.”)

Our (Almost) National Bird

Following a congressional hearing in 1782, the Bald Eagle was selected as the national bird and symbol of the United States. But if Benjamin Franklin had his way, it would have been the turkey. Franklin admired the turkey’s territorial tenacity and had contempt for the eagle’s tendency to steal food from other animals. As he said in a letter to his daughter, “I wish the Bad Eagle had not been chosen…. He is a bird of bad moral character. He does not get his living honestly.”

It’s Not Just the Turkey That’s Stuffed

Conking out on the couch after Thanksgiving dinner is almost a part of the tradition itself. We blame this so-called “turkey coma” on the mistaken belief that turkey is especially high in tryptophan, a sleep-inducing amino acid. The truth is, there just isn’t enough tryptophan in turkey to make you drowsy. (In fact, there’s more in chicken.) Chances are, you couldn’t keep your eyes open after dinner simply because you ate far too much of everything.

This essay and others are available for syndication.

Contact Us for more information.