Sun-Powered, but 10,000 Times More Powerful Than Conventional Solar Energy

“The most powerful engine in our solar system sits a mere 93 million miles away. It fuses atoms together every second, creating more energy than humanity could use in a lifetime.”

Those were the first two sentences of a recent issue of The Daily Disruptor, written by Ian King.

I’ve been a fan of Ian King for quite a while – ever since he became the man behind the very successful trading newsletter Strategic Fortunes. His track record of identifying financial and economic trends is remarkable. But more important to me is that he is equal parts insightful, thoughtful, and modest – a rare and welcome combination in the investment advisory business.

Right now, Ian is excited about a scientific breakthrough that was made at the Los Alamos National Laboratory earlier this year and quietly disclosed to the public in July. He says that what these researchers achieved is a “milestone in fusion energy… that could reshape how America powers its factories and fuels its AI data centers as it reclaims its role as the world’s industrial leader.”

Ian explains:

“For decades, the holy grail of fusion has been ‘ignition.’ That’s the moment a reaction produces more energy than it takes to start it.

“That barrier finally fell in 2022, when scientists at the National Ignition Facility in California made history with a fusion shot that put out more energy than the lasers pumping into it. It was a scientific first and proof that ignition is possible on Earth.

“But ignition is just the beginning. The real prize is what physicists call a ‘burning plasma.’ That’s when the reaction throws off so much heat that it keeps itself alive. Our Sun does this. Its hydrogen atoms collide, fuse, and burn endlessly without outside help. And that’s what’s so exciting about what just happened in Los Alamos.

“Using a new setup called THOR, the team managed to push plasma into that self-heating zone. And for a very brief moment, the reaction didn’t just burn. It fed itself. Now, that might not sound like a big deal, but this has been one of the hardest problems in all of science to solve. It took more than a decade of trial and error just to get lasers aligned perfectly around a fuel pellet to cause ignition.

“The Los Alamos scientists improved on earlier designs with smaller chambers, sharper diagnostics, and smarter modeling. These refinements made the burn more efficient and resulted in a fusion shot that gets us closer to claiming the power of the Sun here on Earth.”

He cautions that the commercial production of fusion energy is not “there yet.” The scale of this experiment was small and the generation of electricity from fusion has not happened. “But it’s a step closer to the day when fusion could deliver nearly unlimited clean energy at costs that fossil fuels just can’t compete with.”

America’s industrial sector accounts for 35% of all US energy consumption. Most of that is in manufacturing.

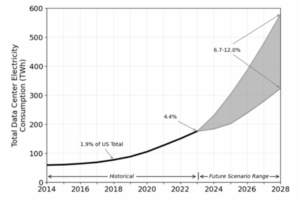

At the same time, AI is triggering a power crunch unlike anything in modern history. By 2028, US data centers are projected to consume 580 terawatt-hours of electricity every year.

Source: US Department of Energy

That’s more than the entire power use of some countries.

Semiconductor factories are also massive energy consumers. Intel’s new Ohio “Silicon Heartland” site is expected to draw as much electricity as a small city. TSMC’s facility in Arizona will need hundreds of megawatts just to operate.

The Energy Information Administration says total US power demand will hit record highs in 2025 and 2026.

And today, natural gas still supplies nearly 40% of that energy.

Ian continues:

“But imagine if America could power all of this with virtually unlimited clean energy that isn’t tied to oil markets, gas pipelines, or foreign suppliers. US consumers already spend about $1.7 trillion a year on energy. That’s nearly 7% of GDP. And that staggering number keeps growing as demand from manufacturing and AI accelerates. But the payoff from abundant energy promises to be just as staggering. That’s why this breakthrough is so exciting. And why government labs aren’t the only ones chasing this dream.”

Private capital is becoming interested in fusion energy and industry leaders are making early bets.

In 2021, fusion companies raised about $1.9 billion. By mid-2025, that number surged past $9 billion. Helion Energy, backed by Sam Altman, has already broken ground on a fusion pilot plant in Washington State that it hopes to have running by 2028. Commonwealth Fusion Systems is targeting the early 2030s for its Virginia plant. And Xcimer Energy is planning a prototype by the end of the decade.

Ian again:

“Fusion is just one piece of a much larger puzzle. Because America is investing across multiple fronts at once. We’re building semiconductors in the desert, EV plants in the Rust Belt, AI datacenters in the South, and quantum labs in Colorado. All these investments will require as much more power as we can possibly produce right now. That’s why we’re also investing in energy breakthroughs that could power them all.

“Moments like these can create generational wealth. We saw it happen with steel in Pittsburgh, cars in Detroit, and semiconductors in Silicon Valley. Each of those industries lifted entire regions. And they made fortunes for those who invested early. With fusion, we could be watching the early signs of something just as big.”

If you’d like to know more about this story and Ian King, click here.