Search results

54 results found.

54 results found.

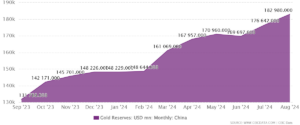

Garrett Baldwin on the Global Shift to Gold

As a consultant to Agora, the largest publisher of financial advice in the world, I read a lot of economic and investment commentary every month. Below, I’m reprinting a good part of an essay published in the 10/18 issue of Postcards from the Republic by one of Agora’s best writers.

Should You Be Buying Gold?

The world has changed how it handles money. Gold now stands at the center of the global system.

For decades, the US dollar has been king. Countries needed dollars to buy oil, making the dollar powerful due to the demand to fulfill transactions. This system was initially called the petrodollar. It was the backbone of America’s economic power from 1971 to the early 1990s.

Following the first Gulf War, the US government expanded its focus. The Treasury quickly got nations (that weren’t so involved in the global oil trade) hooked on US dollar-denominated debt. After roughly 30 more years of additional dollar domination, things are shifting abroad.

We can pinpoint the day that the world shifted under our feet. The West put sanctions on Russia in late February 2022. Western leaders thought they’d cripple Russia’s economy.

Instead, it backfired. Now, the world is engulfed not only in physical wars across the Middle East and in Ukraine but in a quiet economic war that threatens everything we own.

Following the 2022 sanctions and ensuing price caps on Russian oil prices, the West hoped Vladimir Putin’s nation would be unable to engage in global trade. Instead, Russia and China saw an opportunity. They started working together to bypass the dollar.

Here’s how:

1. China created the petro-yuan. It’s a way to buy oil with Chinese money backed by gold.

2. Russia began selling its oil and gas in currencies other than the dollar.

3. Both countries started buying massive amounts of gold. In 2023, central banks worldwide added over 1,000 tons of gold to their reserves. We witnessed the largest purchases of gold by central banks since Richard Nixon took the US off the gold standard.

Why are all these central banks buying gold? Because it’s trustworthy. Countries don’t fully trust China’s money yet. But they trust gold. So, China needed a lot of gold to back up its currency….

Plus, as more countries move away from the dollar, the US might struggle to pay its debts. This could change the value of everything – stocks, bonds, and savings. But gold? It’ll likely keep going up.

So, what should you do?

1. Consider buying gold. Not just coins or bars, but also take a look at gold mining stocks and royalty companies. We have long advocated for the Sprott Physical Gold Trust (PHYS) as a simple, more liquid way to increase gold exposure.

2. Keep an eye on what big banks and countries do with their money.

3. Pay attention to international trade deals, especially those involving China and oil-producing nations. This election could lead to two very different outcomes, but regardless of who wins, the long-term trend is de-dollarization.

This change won’t happen overnight. The US dollar will remain the primary instrument of trade over the next decade. But we see this process accelerating at the moment.

In a world where paper money is getting shakier, gold is becoming the real deal again.

It’s not just shiny metal – it’s a way to protect your wealth and purchasing power in uncertain times.

Stay positive,

Garrett Baldwin

Millionaires Who Can’t Afford to Buy Their Dream Homes

And Why They’re Renting Instead!

Before I took an interest in wealth and wealth building, I took for granted that it is always better to own a home rather than rent one. The logic seemed irrefutable: The dollars you spend on rent are gone forever. They are not “invested,” they are “spent.” But when you own a home, you own a piece of its price appreciation over the years. As the house becomes worth more, so do you.

I held on to this belief longer than I should have. But when I began investing in rental real estate, and had the opportunity to see how that industry works from the inside out, I soon realized that ownership only trumps renting in certain economic situations. And today, in many areas of the world and for many sorts of housing units, it is largely smarter to rent than to buy.

Here’s a piece from the WSJ on this point.

Has California Had Enough of George Soros’s DAs?

In 2014, California launched a grand experiment in progressive criminal justice, appointing George Soros-backed DAs that believed the way to reduce the disproportionate number of African Americans in California jails was to refrain from jailing them for a slew of crimes, including drug possession, resisting arrest, and theft of merchandise whose retail value was less than $1,000.

Advocates, including Gov. Gavin Newsom, said this would save money for taxpayers. What happened, however, was that the social costs have far exceeded any savings. And now California voters are rethinking that initiative.

Click here.

Niall Ferguson: My Journey from a Jerusalem of Ghosts to the Living Jerusalem

“To make proper sense of the bloody events of the past 12 months in the Middle East, I had to go to Vilnius,” writes Niall Ferguson in The Free Press.

“That may strike you as bizarre, as Vilnius is the capital of Lithuania and roughly 1,600 miles from Tel Aviv. But Vilnius was once ‘the Jerusalem of the North’ – that’s what Napoleon called it when he passed through in 1812.”

Read more here.

The Debanking of America

We’ve all read plenty about social media and government-imposed censorship, including demonetizing, deplatforming, and doxxing. Now there is a new way to make your political opponents disappear: debanking.

Click here.

Can the “Good Guys” Save America from Bankruptcy?

David Stockman on Why Trump and Harris Are Dangerous

“When in the course of history’s twists and turns dire necessity becomes the mother of invention,” writes David Stockman in this essay, “it’s usually too late. That’s the case with America’s fiscal derangement at the present time. There is simply not a snowball’s chance in the hot place that either the Trumpified GOP or the beltway blog-controlled Democrats will lift a finger to deflect America’s fiscal doomsday machine from its appointed rendezvous with disaster.”

Read more here.

Freddie deBoer on “Deference Politics”

Why Woke Largesse Doesn’t Help Those It Pretends To

“When I talk about deference politics,” writes Freddie deBoer, “I’m referring to the tendency of left-leaning people to substitute interpersonal obsequiousness towards ‘marginalized groups’ for the actual material change those groups demand.”

Read more here.

From CA re my Aug. 30 essay on “The State of Our Economy”:

“Check out the Aug. CCI (Consumer Confidence Index). Although people with jobs naturally have more confidence than those without, the overall trend is slightly up. That’s not typically what we see heading into a recession. However, economists generally agree that all bets are off for the future if the presidency is won by the candidate who wants to impose huge tariffs on most of the things poor people buy every day. See this link.”

My Response: Thanks for the note, CA. I am aware that there are some polls out there suggesting that, as you say, “consumer confidence” has marginally improved. If you take the stock market as an indicator, it’s more than marginal.

But as I emphasized in my essay, my interest is not in what most people think or feel about the economy, but what the undecided voters in the swing states think. And I provided some data indicating that the sort of person that tends to be unaligned and independent when it comes to national elections would likely be more negative and even pessimistic when it comes to the economy.

A WSJ national poll last week shed some light on this. When voters were asked what issue mattered most to them in the election, the largest share (29%) picked the economy. This was followed by immigration (19%) and abortion (14%). “That is probably good news for Trump,” the WSJ said, noting that concern about immigration also favors him.

As for your statement that “economists generally agree that all bets are off for the future if the presidency is won by the candidate who wants to impose huge tariffs on most of the things poor people buy every day,” I have three things to say. First, I agree: Trump’s tariff ideas will definitely make middle- and working-class consumers poorer because they will be the ones to pay for those tariffs through higher prices. Second: You do know that Kamala has also promised to impose tariffs, right? Plus major tax increases that she falsely claims will affect only the 1%. Third: Most voters understand nothing about the economics of tariffs.

Bottom line: How will the undecided voters in swing states feel about the economy in November? They will feel that it’s worse than it was four years ago… because it is. Considerably worse.

From KW re my Aug. 28 announcement that this will be my last weekly issue:

“Well, here we are again. Here’s how you touched my life (for the good). I was a very early ETR subscriber and eagerly devoured your posts every day. (I wish I still had them all for reference.) Your insights led me to ETR conferences. Which led me to AWAI and Circle of Success. And your relationship with Agora led me to Stansberry Alliance and now Porter’s Partner Pass. And to Bonner Private Research, of course. More importantly, all of that improved my life dramatically and led me on a path that has enriched me in many ways. Thank you so much!

“I had the pleasure of speaking with you briefly at an ETR conference in Delray Beach, and I’ve made many connections through ETR and AWAI. Today, I run a small manufacturer’s rep agency which I am in the process of transforming into a sales and marketing agency. I am ever in your debt.”

My Response: Thanks, KW. Your letter made my day. This is why I have been writing blogs for 24 years, and why I will continue to publish a monthly version of this one in the future.

New York City: Time to Sell?

There is reason to believe that the current burden of the migrants taking advantage of New York City’s sanctuary city status may bankrupt it in the next 12 to 24 months.

The city’s current debt is $132 billion. And yet, Mayor Adams and other city officials are planning on spending a lot more between now and the end of 2025 to pay for the housing, feeding, clothing, and other needs of this additional population.

The city already provides undocumented immigrants with Medicaid and the full range of welfare services for the first seven years of their time spent in the city. City officials believe they will spend $12 billion by the end of the 2025 fiscal year on this alone.

And now they are working on the idea of giving the migrants $350 a week via prepaid debit cards that are supposed to be used to purchase food and supplies for babies. It’s a pilot program that will be tested on 460 families and will cost the city $600,000 a month, or $7.2 million in the first year. But as best as I can ascertain, since 2022, NYC’s migrant population has grown from about 560,000 to about 800,000. And if my arithmetic is right, that means the city would eventually have to come up with an extra $3 billion in taxes to expand the program.

On top of all that, they have a serious problem with office buildings being underoccupied since COVID that has been costing the city billions of dollars a year in lost real estate tax income.

Based on everything I’ve read, I’d not be surprised to see the city’s debt top $200 billion within the next few years.

The only way for Mayor Adams and city officials to try to avoid that would be to drastically increase taxes even more than they’ve already been doing – a tactic that has backfired, with wealthy residents and large, tax-paying companies beginning to relocate out of the city and into less costly municipalities.

If I owned property in NYC, I’d be looking to sell it now.

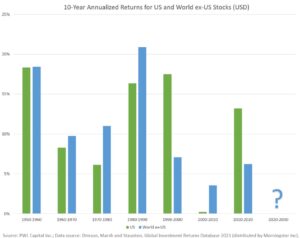

Chart of the Week: Time for Non-US Stocks?

This week, Sean looks at the US stock market and highlights how expensive US stocks have become. (I’ve had conversations about this with several of the best analysts at The Agora Companies, which publishes dozens of economic, wealth, and financial advisories.)

From a value investing perspective, many US stocks, especially the sort of stocks we hold in the Legacy Portfolio are expensive – at a level that, like Sean, I’d be reluctant to buy more of them.

US stocks represent the majority of my investment in stocks, but stocks represent only about 20% of my wealth portfolio. Much of the rest is comprised of hard assets, real estate, and direct ownership of businesses, some of which are overseas. So, that gives my overall wealth portfolio some “anti-fragility.” If your wealth is primarily in US stocks, you should heed Sean’s warning today.

As US stocks inch ever higher, I find myself less interested in them.

I do not wish to overpay for something that, by any valuation measure, seems so unattractive.

This has led me to seek opportunities in gold and bonds. Now, I am looking at emerging markets.

Global markets excluding the US stock market have outperformed the US in five of the last seven decades.

It raises some questions: Why should this decade be different?

Many other investors are starting to ask the same thing.

According to analysts from Bank of America, the shift into emerging market and eurozone equities has been remarkable, with movement into non-US stocks the highest it’s been in seven years.

The last time we saw US stock valuations this high, in the year 2000, non-US stocks proceeded to outperform US stocks in seven of the following 10 years.

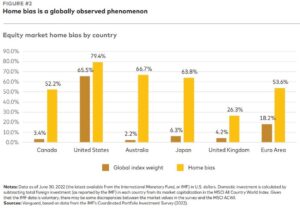

This is cause for concern because, simply, most American investors, especially index investors, believe they have a well-diversified portfolio. Yet most of them do not hold non-US stocks.

Having international assets, like real estate, can help hedge against currency fluctuations. They also allow investors to gain exposure to shifting growth trends.

The most exciting of those growth trends seem, to me, to be in South America, Central America, and Japan. (Though I am keeping an eye on Europe.)

Western Latin countries are benefitting heavily from the trend of nearshoring, where US firms are relocating manufacturing and operations to nearby countries.

And Japan is starting to see growth again after decades of stagnation.

One thing I will be doing in the coming months is looking for a non-US stock to add to the Legacy Portfolio. In July, I will be revealing what I discover on a stage in Tokyo.

But investors should consider shifting about 30% of their portfolio to non-US assets, like international stocks, now.

That might involve taking some gains on US growth stocks and moving them into non-US assets. Or it might simply involve buying non-US assets with your dividends or any new contributions you make to your investment portfolios.

– Sean MacIntyre

Check out Sean’s YouTube channel here.

1. Night at the Fiestas: Stories

By Kristin Valdez Quade

304 pages

Originally published March 16, 2015

I don’t remember how this got onto my to-read list. I half-liked the title – a collection of possibly good, possibly literary short stories from south of the border. But titles, as we know, can be misleading. It could be a compilation of socially astute, Oprah-worthy, cliché-ridden accounts of racism and oppression.

It happened that – and, again, I don’t know why – it had been downloaded onto one of the book apps on my iPhone and I was embarking on an hour’s drive. So I began listening to it. And now, having read (listened to) it and thought about it for a week, I feel comfortable recommending it.

What I Like About It

Kristin Valdez Quade is indeed a literary writer, but in the school of simple sentences and limited flourishes that I prefer, especially when the stories are meant to be experienced (like The Sun Also Rises), not plumbed and researched and then deciphered (like Finnegan’s Wake). So, I like Quade’s style of writing. I also like the amount of detail in her stories that adds depth and dimension to the cultural background in which the stories come alive. And finally, I think she does a very good job with dialogue, which is not easy.

What I Don’t Like (So Much)

There is a minor current of political correctness that runs through the collection, in terms of who the heroes and villains look like, speak like, and act like. It’s there, and I wish it wasn’t. Because had Quade resisted this superficial commercial temptation, the book would have not only received high marks from me in terms of literary style and horizontality, but better grades on verticality as well.

Critical Reception

* “[A] sparkling debut collection… features dreamers and schemers whose lives pulsate with wild hopes, hard luck, stunning secrets, and saving grace.” (Elle)

* “Quade demonstrates her command of writing about complex issues of ethnicity and success head-on.” (San Francisco Chronicle)

* “ Fresh, funny…. A gifted storyteller with an eye for quirky, compelling detail.” (Dallas Morning News)

2. Can This Death Row Inmate Bring Down the Death Penalty Itself?

Death row inmate Richard Glossip in 2014, one year before he was scheduled to die.

A longtime “passion” of mine is the incarceration of people falsely convicted of crime. The idea itself is scary. But what’s really frightening is that I’ve learned from 20 years of involvement in this issue that proving one’s innocence is not, as one would think, a get-out-of-jail pass. On the contrary, the way the system works in most judicial jurisdictions in the US is that, after it’s been proven (often by DNA evidence plus admissions by the actual culprit) that some poor bastard has been incarcerated for 20 years, the DAs do everything they can to keep him in jail (or on death row) because they don’t want to tarnish their prosecution percentages.

For someone not familiar with the facts, this may seem unbelievable. Here’s a typical example from The Free Press that should upset you.

3. What a World: A Grieving Father Recounts His Son’s Dying Moments

Ken Kesey

An important feature of American prose style for the last 100 years is restraint. Restraint in action, restraint in diction, and, especially when describing harrowing experiences, restraint in expressing emotion.

“One icy morning in January of 1984,” Sean Usher writes in the Feb. 3 edition of Letters of Note, “as the University of Oregon’s wrestling team headed on a bus to their next tournament in Pullman, WA, the driver lost control of the vehicle on a mountain road and it tumbled through the guardrail and over a 300-foot cliff. Tragically, not all survived.

“One boy, Lorenzo West, was killed on impact; another, 20-year-old Jed Kesey, was left brain dead. He passed away within days.”

The boy was buried at his family’s farm. A few days later, his father, One Flew Over the Cuckoo’s Nest author Ken Kesey, wrote to five of his closest friends. Here is the power of restraining emotion.

4. How Much Does It Cost to Retire in the 20 Happiest Cities in the World?

We (The Agora Companies) publish all sorts of things about living and retiring abroad, including International Living, which is the largest circulation magazine of its kind. International Living often covers cost-of-living stories about beachside and or mountain areas as well as tropical paradises and low-cost retirement Edens. But I never saw an essay on this topic. Click here.

Putting My Editor’s Hat Back On…

I have spent a fair amount of time in my publishing career training, coaching, and editing new and developing writers. It’s an aspect of my work-life I very much enjoy because it is an intimate and earnest form of teaching. And it has pragmatic benefits, as well. If I do a good job, the writer becomes a stronger writer. As a stronger writer, he wins a larger and more loyal base of readers. As his readership grows, so do the revenues of our business. And that gives our readers a better product, our company larger revenues, and the person I’m coaching a more successful and lucrative career.

Philosophically, what I’m doing provides all three of life’s sustaining pleasures: I’m working productively on something I feel is important. He’s learning something that he thinks is important. And both of us are sharing important knowledge.

In less self-elevating terms, I like it because I’m confident I can do it well and because what I’m doing is appreciated by the person I’m coaching.

That’s all good and true for coaching new and developing writers. But what about a writer who has serious writing credentials? What about coaching a writer that, from an objective perspective, has all (or more) of the professional chops that I have? It can be intimidating!

I’m doing that now. I’ve been working with a very accomplished writer of newspaper and magazine essays and several bestselling books. He’s got more writing medals on his chest than I could claim, but he’s new to the sort of writing we do at Agora: newsletters.

Newsletter writing differs from other kinds in the two ways contained in the word “newsletter.” It is meant to convey some useful insight on economic and investment developments (news). And it is meant to do so in an informal and almost intimate manner (letter).

This particular writer is an expert in his subject matter: investing. In terms of knowledge of that field, he’s way ahead of me. He’s also very good at structuring an argument, telling a story, writing with personality, etc.

So, you would think that there is practically nothing I can teach him. Nothing I can do to help him advance in his new job as a newsletter writer. I wondered about that when I agreed to coach him. And yet, the relationship seems to be working. I’m quite confident that I’m making his writing better!

The icing on the cake is that we are both enjoying the process. As it turns out, as good a writer as he is, he recognizes the value in what I’m teaching him – the nuances that make newsletter writing unique and uniquely valuable to newsletter readers. And that fact makes my job so much easier. He “gets” my comments immediately and puts them into practice as well as (and sometimes better than) I could hope for.

Part of me fears that, in another month or so, I’ll have nothing left to give him. But I know that’s not true. I know, from this experience and from others, that a good writer – even a great writer – will almost always write better with a good editor.

Think about it. Almost every great writer I can think of had editors that greatly improved their work. And not just in the beginning. Throughout their careers. A few examples:

* Max Perkins and Thomas Wolfe

* Ezra Pound and T.S. Eliot

* Max Brod and Franz Kafka

* Michael Pietsch and David Foster Wallace

Quick Bites: A Primer on Inflation… Three Ways to Lose Money in 2024… A Heated Debate… Mike Tyson’s Profound Wisdom… The Dark History of the Werewolf

* Doug Casey on the Destruction of the Dollar. From a recent posting on his International Man website:

“Inflation occurs when the creation of currency outruns the creation of real wealth it can bid for… It isn’t caused by price increases; rather, it causes price increases.

“Inflation is not caused by the butcher, the baker, or the auto maker, although they usually get blamed. On the contrary, by producing real wealth, they fight the effects of inflation. Inflation is the work of government alone, since government alone controls the creation of currency.

“In a true free-market society, the only way a person or organization can legitimately obtain wealth is through production. ‘Making money’ is no different from ‘creating wealth,’ and money is nothing but a certificate of production.”

Click here to read more.

* Three Ways to Lose Money in 2024. Garrett Baldwin, one of Agora’s financial analysts that I follow regularly, published a piece on Oct. 24 that I thought was worth passing on to all of my readers that are active investors. Click here.

* David and Goliath: Douglas and Malcolm. I’m a fan of Malcolm Gladwell. And Douglas Murray. They are both smart and articulate. They write well. They speak well. And most importantly, they think well. So, I was excited to come across this debate between them (and two other writers) on whether mainstream journalism has lost its way. Click here.

* Mike Tyson’s Profound Wisdom. Mike Tyson was always an obviously intelligent person. Spend a half-hour looking at interviews with him when he was in his 20s and you will see that. But he was also a troubled person whose ideas about himself and his self-importance nearly ruined his life. But then, something amazing happened. Some experience that changed him. He expresses it beautifully and succinctly in this conversation with Joe Rogan. Click here.

* An Amusing History of the Werewolf. Click here.

Alarm. Then Complacency.

Addison Wiggin, bestselling author and founder of Agora Financial

At 2:20 EST on Wednesday, Oct. 4, every cellphone in America went off. Did you notice? It was a mass message from the Federal Emergency Management Agency (FEMA). The purpose, they claimed, was to be sure they can “effectively warn the public about emergencies, particularly those on the national level.”

“Spooky,” my friend Addison Wiggin’s son Henry wrote to his dad from his seat on an Amtrak train. “The government is tapped into all our devices!”

Henry described the experience on the train as mass concern and confusion, but just for a moment. “Then, within moments,” he said, “everyone settled back into a weird complacency.”

First confusion. Then complacency. That’s a pattern Addison sees happening in the financial markets today. Read his analysis here.

From SL, re theoretical physicist Sean Carroll’s video – “Talking About Time” – in the Feb. 25 issue:

“As soon as your notes come to my inbox, I drop everything and read them immediately. Thank you so much for sharing your thoughts and insights. I’m a former physicist who has had a career in risk management at global banks. And with recent developments in quantum information and quantum computing, I’ve become excited about physics again…. For an interesting read without equations, I recommend The One by Heinrich Päs. It covers the history of science, philosophy, and theology from Plato and Pythagoras up to the present. Even if parts seem way out there, stick with it. You won’t regret it.”

My Response: Thank you! I will check it out! By the way, there’s another video from Sean Carroll in today’s issue. See “Interesting…” above.

From AD, re “4th of July in Chad” in the Feb. 21 issue:

“I love the pic of the tricycle race… what fun!”

More Data on the Next (Biggest?) Financial Crisis

* The stock market crash of 1987

* The dot-com crash of 1995

* The real estate, banking, and liquidity crisis of 2007

* The COVID-19 government lockdown crisis of 2020 and 2021

Of these four, only the crash of 1987 surprised me. And the market bounced back relatively quickly, so I didn’t have a chance to learn anything from it. The dot-com crash seemed inevitable, given the crazy P/E ratios for dot-com stocks. The only question was: When? The real estate bubble was predictable in the same way. Prices were hyperinflated. They couldn’t possibly land. I was able to avoid getting hurt on that one by sticking to a simple, fundamental rule I use for investing in real estate. (I’ve written about it many times. Most recently, here.) The economic cost of the COVID lockdown was also easy to predict. But there was so much fear around it that nobody wanted to talk about it.

Recently, I’ve been feeling like we are about to go through another financial crisis. And this time, it won’t be short-lived, like the 1987 crash. Nor will it be restricted to segments of the market, like 1995 and 2007. This time, I’m betting it’s going to be across all investment classes and across the globe. And to make matters worse, it’s feeling like it’s going to be a long and debilitating period of stagflation.

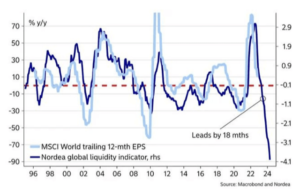

I hope I’m wrong. Here’s a chart I found last week (from Agora Confidential) that is worrying.

This chart offers insight into the amount of global capital sloshing around to purchase bonds and stocks. The Nordea global liquidity indicator – which signals a sharp contraction – typically leads the MSCI (corporate earnings) with a lag.

The MSCI signals that a slowdown is coming for corporate profits into 2023 and 2024. (Mainly as the impact of central bank rate hikes start to affect the global economy.)

If valuation comprehension was the story of 2022… looks like the story of 2023 will be earnings compression. Barring a dramatic pivot by the Federal Reserve, we can expect more volatility and lower stock prices in the year ahead.

I just found out that my book, Ready, Fire, Aim, was recommended by blogger Alex Hormozi as one of the “top 13 business books that every business owner should read.”

Thanks to TJ for sending in this video clip…