Search results

54 results found.

54 results found.

All Fixed Up and Ready to Go!

Friday, September 16: My surgery was scheduled for 12:30 pm. At 9:15 am, K came back from her exercise class to say that there had been a scheduling mix-up. I was supposed to report for my surgery in 15 minutes! The hospital was 30 minutes from our house. As K raced through traffic, I was thinking about another time we rushed to the hospital, 42 years ago, when Number One Son was born.

K got us there at 9:35. I signed in and was rushed to the prep room, where I was hooked up to a heart monitor and an IV. Dr. B came by. So did Dr. Hope. Then the anesthesiologist. I don’t remember getting wheeled into the operating room.

Several hours later, I woke in a recovery room. It was 2:30 pm. Dr Hope was there with another vascular surgeon that had assisted him with my surgery. They were smiling. The operation went “really well,” Dr. Hope said. “And you really, really needed it,” the other one said.

I asked Dr. Hope if they had managed to scrape out all the plaque. “Not all of it, but we got plenty,” he said. “You should be in good shape now.”

I was very happy with that. Given the circumstances as I understood them – three eye strokes and two brain strokes caused by an artery that was 99% occluded – the result was as good as I could have hoped for. Unless something went awry, Dr. Hope said, I would be discharged the very next day.

I nodded off. When I next woke up, K was there. Energized by the outcome of the operation, we spent the next hour or two responding to text messages and phone calls from friends and family and reading emails and texts sent by readers from all over the world.

K left for a while, and I took a nap. When I woke, there was someone, another patient, in the bed next to mine, separated by a curtain. It was a man, an older man. Older, like yours truly. A doctor was with him. They were talking quietly.

Like me, he’d had a stroke. But his had been caused by internal bleeding, not a blockage. He must have lost a good deal of blood because he was being given a transfusion.

From his palaver with the nurses and aides after the doctor left, I learned that his name was Samuel, but he preferred to be called Sam. He was hard of hearing. And his memory wasn’t great. But his demeanor was cheerful, and he was polite. I decided that I liked him and wanted to help him get ready for what he was in for. I would give him the lay of the land.

“Sam!” I whispered.

Nothing.

I raised my voice. “Sam, can you hear me?”

Nothing.

Several times in the following hour, I called out to him. To be sure, he could hear me. I spoke up, but not so loudly as to attract the attention of the nurses. I don’t know why, but I didn’t want them to hear us talking. I felt conspiratorial. In my post-op mind fog, Sam was the faceless prisoner in the cell next to mine.

Eventually, K came back and stayed till visiting hours ended at 8:00. I was happy but exhausted and fell asleep as soon as she left the room. I slept through breakfast and woke when K arrived at 10:00. The charge nurse came in to say I’d be discharged after lunch. This was my last hospital meal:

I’m writing this on Monday morning. I have a six-inch scar on the side of my throat and a little swelling, which will abate soon enough. This is me, yesterday at breakfast:

But I’m feeling good. And lucky. And happy to be alive. I haven’t always felt that way. I’ve written about my bouts of depression and anxiety. I wrote about my down periods because I thought it would be helpful to some readers. And I’ve been told that it was. But it occurs to me now that I haven’t written much about my up periods.

When I’m feeling good, I feel like working. I want to continue to work for Agora, to help it regain its footing and grow. I want to continue to develop FunLimon and Rancho Santana and Paradise Palms. I want to continue with the art collection and build the museum. I may even finish a few of the books I’ve half-written.

I know that I’ll never be done with any of it. And I know that so long as I’m feeling good, I’ll be creating new projects and plans. But I’m not going to stress about any of them. I’m going to be intentional without emotional attachment. I’m going to get healthy. And stay healthy for as long as my body allows. I’m going to carve out more time for family and friends. And for K, if she’ll let me. I’m going to see my grandkids on a regular basis and close my laptop when someone enters the room.

So long as I’m feeling good, I’m going to keep working. But it’s going to be projects I care about, and it’s going to be one project, and one day, at a time.

Questions and requests:

“Hi Mark, what’s your opinion on mastermind groups? I’m wanting to connect with more experienced business owners and raise the bar of my business and my skills. Do you recommend any?” – AB

My Response: I’m all for them. I’ve never been to any sort of “mastermind” session, formal or informal, without coming away from it with at least several good ideas. Growing a business means creating constant change and constant change requires a constant source of new ideas. No one idea is a placebo. And many ideas are not appropriate for a given business at a given time. But that’s not a problem for the entrepreneur that is willing to consider new ideas and test them intelligently. More is better when it comes to business- and wealth-building ideas.

“Dear Mr. Ford – What is the biggest challenge any of your companies is facing that’s keeping you up at night and you must solve now?” – SV

My Response: Biggest challenges change as companies grow. When you are starting out, the biggest problem is finding out how to sell your products/services profitably before you run out of money, time, and/or patience. At other stages, the biggest problems are related to scaling. Or management. Or talent. If you’d like to know more, you should read a book I wrote about the big changes and how to deal with them. It’s called Ready, Fire, Aim.

“I’d like to create winning health promotions for The Agora Company. But I’m not sure how to go about it. Please, I’d love your advice and guidance. Looking forward to your response. Thank you.” – HO

My Response: I don’t pass along requests like this to my colleagues in Agora or to any other colleagues in any of my businesses. Not because they might not be useful, but because if I did I’d begin to get a hundred a day and my colleagues would stop talking to me. If you want to write advertising copy for Agora’s health publishing division, you should do some research and find out how they want to be approached. And then learn as much as you can about their products and their advertising so that, when you approach them, your letter will stand out from the rest.

Re the Amazon drone delivery video in the July 22 issue:

“The Amazon drone delivery video was super futuristic for a baby boomer like me. Having once owned a business, I couldn’t help but wonder, ‘Does Amazon get the box used by the drones to carry the items back, or does the recipient keep it? It can’t be cheap to use those boxes one time only. Are they recyclable?” – AS

My Response: Amazon has made a big deal out of its efforts to make its packaging recyclable. So, once the drone delivery service is up and running, I’m assuming there will be some way to recycle whatever packaging they’re going to use for it. Most items will probably be in the usual cardboard box. For items that have to go in the plastic bin shown in the video, I’m guessing there will be an extra fee for the bin that will be refunded when you return it to one of Amazon’s already established drop-off locations (Whole Foods, UPS, Kohl’s stores, etc.).

The parents were immigrants from Korea…

They barely spoke English. But by the time I knew them, they had a small business. A sandwich shop across the street from Agora’s first headquarters, in a predominantly African American neighborhood in East Baltimore.

The shop was open from 6:00 in the morning to 7:00 in the evening. It was where our employees bought breakfasts, lunches, and sometimes packaged dinners when they were working late. The parents were there every day. Six days a week. From opening to closing. Their kids were there all day on Saturdays and on weekdays. When the eldest child went to college, she worked only Saturdays and her sisters picked up the slack. After she graduated, she worked full-time while the next child went off to college. And when that child graduated, she went on to pursue her career.

All three children went on to become doctors or lawyers. And when they were making the big bucks, they bought their parents a nice house where they could live out their retirement in comfort and happiness, with lots of time for the grandkids.

Athens, Greece

Kathy and I traveled first to Europe for several weeks after completing my two-year, Peace Corps stint in Africa. One of our favorite cities was Athens. We’ve been back only once since then, and it was terrific. It’s a city we will travel to again.

What I Like About Athens

All 10 of the following must-see tourist sites:

* Acropolis

* Acropolis Museum

* Parthenon

* Ancient Agora and Temple of Hephaestus

* Theatre of Dionysus

* Tower of the Winds in the Roman Agora

* views from Mount Lycabettus

* Panathenaic Stadium

* Church of Panagia Kapnikarea

* Philopappos Hill

Plus…

* Plaka (a very cool neighborhood)

* drinks at a rooftop bar at the end of the day

* Kerameikos (if you like cemeteries)

* National Archaeological Museum (if you like ancient architecture)

Chicago

I spent most of the summer of 2007 in Chicago, working on Ready, Fire, Aim. I needed to be away from home for several months to focus on finishing the book. That need dovetailed with a longstanding dream I had about getting to know some of the great cities of the world by living in them for more than just a few weeks.

I’ve been writing a bit lately about what a sh*thole Chicago has become. In fairness, my current assessment of the city is based on reading reports on the upswing in crime and how poorly the mayor has been handling it.

But I remember Chicago as a great city. A city that had nearly everything that New York had to offer, but cleaner and with nicer people. A big city with big-city amenities, but without the pretension and high costs. (And I remember it as a place where I think I did some of my best writing.)

What I like about Chicago:

* The arts – Chicago has, as I said, everything that NYC offers.

* The shopping – I don’t know how it is now with all the crime, but North Michigan Avenue (the “Magnificent Mile”) boasts as many great stores as anywhere else.

* The architecture – from Louis Sullivan to Mies van der Rohe and Frank Lloyd Wright.

* The music – Chicago is known not only for jazz, but also the Chicago Symphony Orchestra and Lyric Opera.

* The parks.

* The beach.

Why I Haven’t Retired: It’s Hard to Explain…

When I complain about how much work I have to do, K says, “Well then, quit.”

I say, “I can’t quit.”

She says, “Of course you can. You could have retired 40 years ago.”

Then I say, “I don’t want to quit.”

Then she says, “Well then, stop complaining!”

She has a point. But when it comes to these later years of working, I want my cake and I want to eat it. I want to keep working and, when work is hard, I want to complain about it.

How to explain?

I want to keep working because I value the work I’m doing. I think – I know – that it’s useful. To some, I believe it is important. It also gives me a great deal of satisfaction. But it’s difficult. And time consuming. And sometimes downright upsetting.

Work is not play.

Play is fun. And I have playtime. I have my grappling, my crossword puzzles, my computer chess, and my cigar smoking. Two hours of that sort of fun per day fills my play tank. My work tank is bigger. Much bigger. But it’s also, despite the stress and toil, more satisfying.

But K is right. I choose to work. And so, I must also choose to accept all that comes with it and stop bitching.

Marketing Mastery Series

Labels, Lizards, and Limbic Systems:

Understanding the Buyer Brain

They say you shouldn’t judge a book by its cover. And that’s generally good advice. But most people do. Including me. We respond instinctively and emotionally to everything our senses encounter (and particularly to new sensations) because our brains are wired to do so.

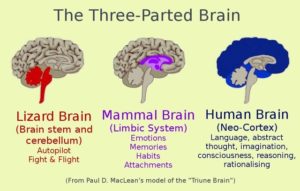

There are three forms of natural intelligence and three intelligence systems in the human brain. The reptilian – or lizard – brain, the limbic brain, and the neocortical brain. Only one of them – the neocortical brain – is capable of not judging a book by its cover. The other two handle the other two forms of intelligence: instinct (the lizard brain) and feeling (the limbic brain).

Because Homo sapiens are naturally conceited, we tend to downplay the importance of our natural intelligence systems – instinct and feeling – and overplay the importance of what is unique to us – thinking. We shouldn’t. They are equally important. (One could argue, in fact, that, next to the opposable thumb, the development of the two “lower” levels of intelligence is the reason our species survived the early eons of evolution.)

Our decisions – big and small – are initiated in the limbic brain. Some, like pulling one’s hand from a hot stove, start and end there. Some, like falling in love, begin in the lizard brain, but grow and flourish in the limbic. And some, like the decision to buy a new car, are routed from the lizard brain to the limbic and then to the neocortical, where the decision is actually made.

None take place solely in the emotional or the rational brain. They all start with that first instinctive reaction.

Most people understand this at some unconscious or rudimentary level. And some people that study decision making understand it quite well. In the world of marketing, understanding how decisions are made is essential. Yet most of what I’ve read and heard from so-called marketing experts is flawed in this respect. They view the buying decision as a two-part process.

General (brand) advertisers see it as instinct and then emotion. Direct response advertisers see it as emotion and rationalization.

But if you want to be a master marketer, you have to understand that the buying decision is always a three-part process. And that means the selling strategy should be a three-part process, too.

First, is the lizard reaction, which takes less than a second. Second, is the emotional impulse, which can take place in several minutes to as long as an hour. Third is the rationalization, which has no time limit. It can take minutes. Or hours. Or days. Or months. Even years.

To repeat…

* The lizard reaction: This is the first instinctive signal that flashes through the prospective buyer’s brain when he/she first looks at the advertising.

* The emotional impulse: The limbic brain then moves in (tentatively or eagerly) to form an emotion.

* The rationalization: After the emotion is formed, the rational brain kicks in and does its work.

Important: These three brain functions – the reptilian reaction, the limbic impulse, and the rationalization – always occur in that order.

What does this mean to you, the aspiring marketing master?

Do you see what I’m saying here? This feels like an important insight to me. I’m not sure, though, if I’ve explained it well. Let me know if you grok this. If not, I’ll dig into it again in another issue.

News & Views

COVID Update 1: Lockdown Scorecard

If you don’t want to believe it, this probably won’t change your mind. But a major study has just been published that concludes that the COVID lockdown had “little to no effect” on saving lives during the pandemic, but had “enormous economic and social costs where [the restrictions were] adopted.”

You can read the entire 69-page report here.

Or a summary of it here.

COVID Update 2: The Pandemic of the Unvaccinated

When Omicron was classified as a “Variant of Concern” by the WHO in November, just about everyone in the pro-vaccination community, from President Biden to Nancy Pelosi to Rachel Maddow to Howard Stern, began calling COVID a “pandemic of the unvaccinated.”

I thought that was a catchy phrase. But I was sort of appalled by the vitriolic sentiment that went along with it. (Howard Stern, for example, suggested that hospitals should not admit unvaccinated people.)

Since then, we’ve learned that vaccinations were not – and are not – able to provide immunity against or stop the spread of the virus. Latest fact I could find: Of the 77 million people that have been infected by the Omicron strain of COVID-19, only 11% (or 8 million) of them were not vaccinated. In other words, For the other 69 million, vaccinations didn’t stop the spread.

Complicated: College Discrimination Suit

The US Supreme Court is going to hear arguments about the role of race in the college admission process.

The Students for Fair Admissions claims that both Harvard, a private school, and the University of North Carolina, a public school, have been illegally restricting admissions for Asian-American applicants. (Harvard’s policies will be tested against the Civil Rights Act; UNC’s against the 14th Amendment.)

This is not news. Asian-American parents and educators have been objecting to these policies for decades. (How the issue finally made its way to the Supreme Court is a story for another day.)

It should be an interesting case. If the suit succeeds, it could put an end to all quota systems, including affirmative action admissions.

What I Believe: I believe that affirmative action – at some level and in some cases – is a natural and useful idea. But I also believe that it is ineluctably discriminatory. When the average GPAs and test scores of one racial community are disproportionately lower than those of another, the only way to admit more of the lower-performing group is to discriminate against the higher-performing group.

The arithmetic here is irrefutable, but there is an out that the Supreme Court can take if it wishes. And that is to say that objective measurements of performance (GPAs, testing, and even extra-curricular activities) are only part of what should be considered in making admission decisions. Subjective criteria (such as personality) are important, too. And this, in fact, is what Harvard and UNC do. Of course, the only way to logically employ this argument is to suggest that Asians have “less attractive” personalities.

Good to Know

About the Vietnam War

The war in Vietnam began in 1955. The US got involved in 1965. I don’t remember knowing anything about it until I entered high school, in 1964. Opposition to the war was a fringe issue then. But by 1968, negotiations to end the war officially began. Protests continued until 1973, when the governments of Vietnam and the United States signed the Paris Peace Accords. The agreement required the immediate withdrawal of all US troops, the return of prisoners of war, and the reunification of Vietnam through peaceful means. By that time, more than 1.3 million soldiers and civilians had been killed. Yet after US forces were removed from the conflict, the warring factions in Vietnam resumed fighting. Two years later, North Vietnam captured Saigon, the capital city of South Vietnam, and began reunification of the country under socialist rule, officially bringing an end to the Vietnam War.

Recommended Places

The Romance and Magic of Cartagena

Founded in 1533, Cartagena is a port city on Colombia’s Caribbean coast. It’s a short plane ride from Miami. Because of its beauty, history, and location, it’s one of the most visited cities in South America.

What I like about Cartagena:

* The architecture. Cartagena may be the most beautifully preserved Spanish Colonial city I’ve ever seen.

* The street art – murals, sculpture, and graffiti – in the Getsemani neighborhood.

* At night, the city is saturated with music and dancing – in clubs and outdoors in parks.

* It is an oasis for foodies, from street tapas to fine dining.

* Lots of interesting churches and monasteries throughout the city, including the San Pedro Claver Monastery.

Arts & Letters

From Letters of Note: Ralph Waldo Emerson to his daughter, April 8, 1854

“Finish every day and be done with it. For manners and for wise living it is a vice to remember. You have done what you could; some blunders and absurdities no doubt crept in; forget them as soon as you can. To-morrow is a new day; you shall begin it well and serenely, and with too high a spirit to be cumbered with your old nonsense. This day for all that is good and fair. It is too dear, with its hopes and invitations, to waste a moment on the rotten yesterdays.”

Words to the Wise

* A word I’d like to bring back into common parlance: ken

Rarely used today outside of the phrase “beyond one’s ken,” it means “range of vision or comprehension.” It goes all the way back to Proto-Indo-European, the ancestor of most European, Near Eastern, and South Asian languages. Its many relatives in modern English – all coming from the root “gno-” (“to know”) – include incognito, cunning, and know itself.

* A word I should know but don’t: scofflaw

A scofflaw is a person who habitually violates the law, especially laws that are difficult to enforce. Example: “A scofflaw seeks not to overturn the existing system – it may in fact be to his advantage if everyone else were to conform to it – but to flout it.” (God, Belief, and Perplexity by William E. Mann)

* A word I’m going to try to wedge into the next conversation I have about space: spaghettification

Spaghettification – also known as the “noodle effect” – is the theoretical vertical stretching of an object as it encounters extreme differences in gravitational forces, especially those associated with a black hole.

Readers Write

Re Ready, Fire, Aim:

“Ready, Fire, Aim is vintage Michael Masterson. Every sentence in the book is stuff you can use right now, today, to accelerate your climb to the top of the financial ladder. What sets Masterson apart from most of the gurus who write about how to do it is that he’s actually done it – over… and over… and over again. The number of successful businesses he’s built is no less than astonishing. Every serious entrepreneur needs to avail himself of the information in this book.” – RR

Re my prediction in the Feb. 3 issue that the digital dollar will eventually take over, at which point the government (and big tech) would have full financial control of US citizens:

“I wouldn’t have thought of this as an outcome/goal of the gov/big tech back in 2019, but after living through the past 2 years, I have no doubt you are spot on.” – DA

Thoughts on Re-reading Ready, Fire, Aim:

The Inevitable Bloating of Corporate Payroll

If your business grows long or large enough, you are going to encounter payroll bloat – some number of employees at all levels of the biz that contribute little or nothing to the bottom line.

During the early stages of your company’s growth, you won’t have any trouble noticing this corporate rot and getting rid of it. That’s because (1) as the initial CEO of a relatively small company you will be close enough to see it. And (2) as the founder and principal shareholder, you will not tolerate waste.

But when the business gets larger – with tens of millions of dollars in revenues and several hundred employees – you will be far removed from the front lines. And those well-paid, low-to-no-contribution workers will start to disappear from your sight. You won’t notice them physically, because they’ll be floors or buildings or even cities away. And you won’t notice them on the P&Ls, because their costs will be several levels subordinated to the lines you are looking at.

I’ve seen this happen more than once. Because my interest in business is growth, when revenues and profits are rising, I’m not looking for leaks. But whenever I have looked, there’s always been some level of payroll waste.

I’m talking about redundant jobs. Full-time employees being paid to do part-time work. Highly paid execs doing little more than intermediating information.

What was scary about many of these investigations was that nobody was saying a damn thing about them. Not the department heads or management teams. Not the accounting department. And, of course, not a word from the employees that were underchallenged.

I don’t think these people were “covering up.” I think they simply weren’t aware of what had happened. The erosion of personnel productivity took place over years, little by little. Big-business regulations kicked in at a certain level, requiring the firing of red-tape processers. And certain functions, once necessary, became vestigial.

Carl Icahn, one of Wall Street’s most successful investors, ran into that problem several times in his career of building several huge businesses. I remember reading in one of his books or perhaps a magazine article that he made it a practice to fire 10% of his employees each year.

That could be apocryphal. I hope it isn’t, because I always thought it highlighted this problem – that with every additional layer of growth there will likely be an extra layer of low-output employees that must be repurposed or dismissed.

Click here to listen to Icahn tell a funny story about one of the times that he dealt with this problem.

News & Views: Law & Disorder Update

In my effort to keep you abreast of the rise in violent crime in America’s largest cities, here are three quick updates:

* Car thefts rampant in Portland. Click here.

* Chicago 2021: highest number of homicides in 25 years. Click here.

* Rookie cop gets shot on way to work in New York. Click here.

Interesting: About US Military History

How Many Times Has the US Declared War?

The United States has officially declared war 11 times during five separate military conflicts. The last time was during World War II.

The Korean War, the War in Vietnam, and the extended campaigns in Afghanistan and Iraq were not officially “wars.” They were military “actions” or “conflicts.”

The difference matters. According to the Constitution, our presidents are not authorized to declare war. Only Congress is. The founding fathers wisely wanted to make it difficult for us to get into expensive and deadly military engagements. It was almost as if they anticipated President Eisenhower’s 1961 warning about the “military-industrial complex”:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.” – Dwight D. Eisenhower

From Letters of Note: John Steinbeck to His Lovesick Son, Nov. 10, 1958

“Thom,

“There are several kinds of love. One is a selfish, mean, grasping, egotistical thing which uses love for self-importance. This is the ugly and crippling kind. The other is an outpouring of everything good in you – of kindness and consideration and respect – not only the social respect of manners but the greater respect which is recognition of another person as unique and valuable. The first kind can make you sick and small and weak but the second can release in you strength and courage and goodness and even wisdom you didn’t know you had….

“And don’t worry about losing. If it is right, it happens. The main thing is not to hurry. Nothing good gets away.”

Great Places to Visit When You’re in LA:

The Getty Villa Museum

You’ve heard of The Getty Center in LA. By any standard, the museum and gardens are a must-see. Less known, but well worth a sunny morning, is the Getty Villa Museum in Malibu.

Another legacy project of J. Paul Getty, it is dedicated to the study of Greek and Roman art and culture. The collection is huge, with more than 44,000 antiquities from 6,500 BC to 400 AD.

Worth Quoting

* “Success has always been easy to measure. It is the distance between one’s origins and one’s final achievement that matters.” – Michael Korda

* “To leave the world richer – that is the ultimate success.” – Eleanor Roosevelt

* “There is only one success… to be able to spend your own life in your own way,

and not to give others absurd maddening claims upon it.” – Christopher Morley

Readers Write…

Re the Feb. 3 issue:

CF on “The Digital Dollar” – “I thought your prediction was crazy when you made it. Now, I’m starting to believe!”

PJC on “The Problem With Managers Managing Up” – “Thank you for that piece on managers that ‘manage up.’ It came at just the right time. I’ve been puzzling about a profit center of our biz that has been falling off of late. I think you nailed it.”

AS on Buster Keaton vs. Charlie Chaplin – “I am still amazed at [Keaton’s] tenacity and creativity in a time well before special effects. How he didn’t break every bone in his body is a mystery.”

A Bird in the Hand

My Approach to Building Wealth

When I think about investing – whether it is investing my time or my money – I begin by asking myself: What sort of thing is it that I’d be investing in?

Is it a business – like Agora Publishing or Microsoft? Or is it a financial asset – like gold or Bitcoin or a work of art?

I make this distinction because it is very fundamental to how I think about wealth building.

There is a big difference between investing in a business and investing in any other sort of financial asset.

A business is more than a financial thing whose value fluctuates based on supply and demand. A business is dynamic and operates with motivation and intent. It functions as a natural organism, like a plant or an animal, because it is a natural organism, composed, as it is, by natural beings.

A business has a purpose – which is to sell its products and services at a profit. It does this through constant change and adaptability to the environment within which it exists. Cash flow is its life blood. Customer satisfaction is its inevitable and evolutionary purpose. And profit is how it measures its health.

Financial assets like gold or cryptocurrencies do not function as natural organisms. They are not conscious. They have no intrinsic purpose. They are not capable of making a profit. Their value depends entirely on how much, at any given time, people are willing to pay for them.

Investments vs. Speculations

When I buy stocks, I am buying shares in ongoing businesses. When I buy corporate bonds, I am making loans to such businesses. I call these sorts of transactions investments.

When I buy gold (as I have) or cryptocurrencies (as I have) or art (as I do all the time), I am buying an asset whose value I hope will appreciate. The chance of that happening depends not on anything the asset does, but on the buying public’s perception of its value. However clever I think I may be in guessing future demand for the asset, I don’t have any real idea of whether that will happen. I don’t know its revenue history or its P/E ratio because it has none. For that reason, I consider such transactions to be speculations.

Prudent wealth building, in my view, is a matter of giving preference to transactions whose outcomes are relatively predictable. And that means investments that I can understand relatively well and, if at all possible, have some control over.

These two factors – knowledge and control – are how I rate my likelihood of success in making all my financial decisions.

Another way of thinking about this is to look at wealth building opportunities in terms of appreciation and income. When I buy a work of art or a parcel of undeveloped land, I am hoping that its value will appreciate. When I buy a bond, I am counting on the income it will give me over time.

I would much prefer owning a building I can rent out than a parcel of land, because the former provides both income and potential appreciation, while the latter gives me only the possibility of value gain.

My favorite investments are those that offer both income and appreciation and that I fairly well understand and at least partially control.

That doesn’t mean I don’t speculate. I do. But I try to keep the balance between investments and speculations to about 80/20.

Among the speculations I’ve made over the years, some – especially those that have a long history of appreciating – have proven more reliable than others. Gold is such a speculation. It isn’t a business. It doesn’t produce income. But it is considered by the entire world to be a store of value and it has a 2,000-year history of maintaining its value. That makes gold (and other precious metals) a priori safer than cryptocurrencies. I can say the same thing about art.

But between those two, I prefer my art because there is absolutely nothing I can do to affect the price of gold, whereas there is something I can do (promotion and advertising) to increase the value of my art.

If I were to show you my portfolios of financial assets, you would see a direct correlation between the amounts I have invested in each and the four factors of knowledge/control and income/appreciation.

The largest portion of my wealth resides in income-producing businesses. After that is rental real estate. Both portfolios provide me with all four factors.

Below that – in terms of the percentage of my net worth – are my stock portfolios, which provide both income and appreciation, and about which I can know something, but over which I have no control. Then I have my bonds, which are like owning businesses, but without the appreciation.

Below stocks and bonds are all my speculations. My favorite is art, because, as I said, I know a good deal about the art I buy and I can, to some extent, affect the price I get for it. After that, it’s gold. I have no control over its value, and it provides no income. But though it may not skyrocket in value, it’s more than likely to hold its own.

And then, below these assets, are such things as cryptocurrencies and (if I end up investing in any) NFTs. I put these at the bottom because they aren’t businesses, they don’t create profits, they don’t provide income, and the possibility that they will appreciate is entirely out of my hands.

To Be Sure…

I get why many people like NE are so excited about the rapid advances in technology that are creating new money-making opportunities like cryptocurrencies and NFTs. Huge fortunes have always been made by speculating on future trends.

But it’s not in my nature to use my time and money that way. My wealth-building philosophy is summed up in a very simple phrase: “A bird in the hand is worth two in the bush.”

Mine is not a strategy to get very rich, very quickly. But it does offer the advantage of a great degree of relative safety, where you can pretty much guarantee (engineer) that your wealth will continue to grow, year after year.

I did invest cryptocurrencies – five of them – several years ago. And they have appreciated by more than 600%, which is something my more conservative investments have rarely, if ever, done. And, yes, I sometimes think I wish I had invested more than one-tenth of 1% of my net worth in them. But then I remind myself: My bird-in-the-hand strategy for building wealth has served me well over the years.

I will continue to speculate now and then when someone like NE presents a persuasive case. But when I do, I will assume that I’m going to lose all of my money. With that thought in mind to begin with, I can enjoy the ride without needing a positive outcome.

The Need for Speed

Some people are analytical. They tend to move slowly, crossing their t’s and dotting their i’s. Others are action-oriented. They tend to move quickly, impatient for solutions.

To grow a successful enterprise of any sort, you need both kinds of people. But in the early stages of growth, the fast movers need to take the lead.

There are good reasons for this that I discuss in some depth in Ready, Fire, Aim, my book on growing entrepreneurial businesses. But they all tie into one of my favorite themes: entropy. The moment you initiate forward progress, just about everything around you clicks into push-back mode. If you don’t press forward to accelerate your forward momentum, entropy will eat you up.

This is an easy concept for action-oriented leaders to understand. But what is sometimes not understood is that it’s never enough to do the pushing yourself. You must create a culture that supports it – a culture of Speed.

I was going to write a follow-up essay on this idea today, but then I saw the following from Craig Ballantyne, the man that took over Early to Rise as partner and editor-in-chief 10 years ago…

I just hosted another epic mastermind a couple weeks back… our best one yet, and attendees seemed to agree…

[There] was ONE common theme that kept emerging…

SPEED.

Whether it’s making a fast judgement call in order to quickly move to the next phase of your project…

Jumping on a market or idea quickly, thereby beating your competition to the punch…

Or just rapidly growing your business to reach your goals in less time…

Speed is so frequently the answer to your problems.

Craig then listed 3 “fast hacks,” as he calls them, to help his clients create a culture of speed when their businesses need it…

This is one of the most important lessons from my mentor Mark Ford…

He impressed upon me that sales is the driving force of your business…

Especially in the early stage.

Therefore…

You should spend 80% of your time driving sales and marketing efforts.

No matter how you slice it, failure is part of the process…

… another concept Ford addresses in his book Ready, Fire, Aim

(strongly suggested reading material)

And by accelerating failure, we also accelerate success.

However, failing faster alone is not enough.

We must be sure to learn from these mistakes in order to become more efficient over time.

An objective best served by:

Not the primary goal. But realizing it’s expected and okay when it happens.

For example…

Failed marketing attempts should be analyzed against successful ones to gain insights for future efforts.

Stop questioning, second guessing, over analyzing, and essentially paralyzing yourself with perfectionism.

There’s a reason you’re where you are today, doing what you’re doing…

Trust yourself.

Stop driving with one foot on the brake and just do what you think is right…

You’ll find your instincts are often right.

And the wins you do get by seizing opportunities immediately will far outweigh the losses.

Plus if you do fail… (refer to #2)

So remember…

When it comes to progress… SPEED is the answer.

And through focused attention on seemingly simple ideas like these…

You’ll be able to scale your business in a fraction of the time you’d originally anticipated.

“Life is a series of natural and spontaneous changes. Don’t resist them; that only creates sorrow. Let reality be reality. Let things flow naturally forward in whatever way they like.” – Lao Tzu

Advice to “Shark Tank” Wannabes:

Don’t Fret the Business Plan… Obey the Market

“Shark Tank,” the enormously popular TV show, is about entrepreneurs vying for money to fund their ideas. They win or lose based on their business plans and how well they present them.

It’s a bogus concept. Anyone that knows anything about how venture capital works, including the celebrity entrepreneurs that act as judges on the show, knows it.

What’s BS about the show is the focus on the business plan itself. Business plans matter, but not nearly as much as most people think. And when it comes to start-up ventures, the initial plans matter even less.

That’s because in the real world nothing is static. The economy is in a continuous state of change. Industries are forever shrinking and/or expanding. Supply and demand changes on a daily basis. And this is to say nothing of the infinitely complex and unpredictable nature of the human beings that comprise the business experience: the managers, the employees, the vendors, and the customers.

Business plans, however, are by nature static. They are based on facts and assumptions that are true for some limited period of time. Bigger plans – those that contain more facts and assumptions – may have the appearance of being more reliable, because they take so much more into consideration. But in fact, they are less stable – precisely because they contain more parts that are likely to move.

I’ve been involved in more business start-ups than I can count. When I think about the best of them, I can’t think of a single one that succeeded by faithfully following its original plan.

On the contrary, the most successful businesses I’ve been involved with at inception – the ones that grew to into thriving, enduring, multimillion-dollar companies – were all started with plans that were sketchy. Literally sketchy – with the core ideas recorded as sketches on scraps of papers.

The simple truth about entrepreneurship is this: It’s much more about the ingenuity, tenaciousness, and flexibility of the founders than about their ability to make perfect plans.

And that is why, in the past 20 years, the average business plan required by venture capitalists has shrunk from 75-100 pages to 15-25. Angel investors today understand that successful start-ups are not those that begin with amazing plans but with amazing people that have the ability to adapt quickly and enthusiastically to changing market conditions.

Do you recognize the name David H. McConnell?

He began his career as a traveling salesman. He sold books. Over several years of trying out a variety of whimsical sales pitches, he discovered that he could increase sales by giving potential customers perfume samples as a bonus.

I know! It doesn’t make sense. But the gimmick worked. It worked so well that he trashed his plan for building a bookselling empire and replaced it with a plan to sell perfumes.

He hired 13 female sales representatives (mostly former customers) and set them to work. A decade later, he had a sales staff of 5000. His business then was called the California Perfume Company.

Later, he changed the name to Avon.

The Takeaway: You don’t need a perfect plan to start a great business. You need a plan that is flexible enough to guide you through all the changes you’ll be making as your business grows.

Recommendation: If this idea feels important to you, get yourself a copy of Ready, Fire, Aim.

This essay and others are available for syndication. Contact Us for more information.