“Inside of every problem lies an opportunity.” – Robert Kiyosaki

Where to Invest in Real Estate in 2021 and 2022?

Back in June, I said that my partners and I had put a hold on plans for a $14 million company-occupied office building. Though I wasn’t concerned about the future of that kind of real estate, we wanted to see what would happen with the economy before committing to construction.

That was then. Here’s what I’m thinking now…

Office space will never recover fully. Those of us that own commercial office properties will be lucky if rental income climbs back up to 70% of where it was.

So where is the opportunity in real estate going to be in 2021 and 2022?

And what should my partners and I do with all these damn office buildings we own that will now be less than fully occupied?

In a recent issue of Empire Financial Daily, Whitney Tilson had this to say…

[In June] people were fleeing urban apartments and seeking more room for home offices along with private outdoor space.

Even that early in the pandemic, it was clear that the nature of work could be permanently altered – with less time in the office likely an enduring reality for many folks – supporting the possibility that temporary relocations could become permanent.

In October, I said pretty much the same thing, and noted an email I had received from a tenant in one of our buildings. They were not renewing their lease because “Our employees have told us that they like working at home and, as you’ve noticed from the monthly reports, the business hasn’t suffered in terms of revenues or profits. This will save us more than $100,000 next year.”

Whitney again:

What I didn’t appreciate at the time – and what has become a key tailwind for strength in housing prices – is how constructive the supply side of the equation has proven to be…. [T]ight supply is proving far more persistent than what a few weeks of building shutdowns would create.

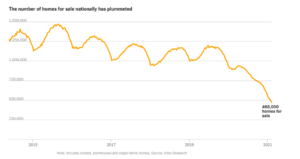

Put into hard numbers, there were nearly 500,000 fewer homes available for sale in February 2021 versus February 2020. You can see the dramatic decline in inventory in this chart from The New York Times…

What’s driving the supply shortages?

Whitney has several theories:

* Some retirement-age people are putting off selling their homes until the COVID scare is over. “The idea of having a bunch of strangers traipse through the house you live in is off-putting in the best of times, and the past year held risks that went beyond mere inconvenience.”

* The supply of new housing builds “never recovered to the levels seen before the industry crash of 2008 and 2009. In classic feast-to-famine mode, the homebuilding industry may have overcorrected.”

* Low interest rates (which have been in place for nearly 13 years now) “have incentivized people to get into the landlord business.” (In fact, the number of homes for rent – not sale – has surged while the supply of new houses has dipped.)

All of this suggests that the smart money should be directed into the residential housing market. But there is one caveat, which Whitney notes. For the last 8 years or so, the cost of new housing and new construction has been going up, but average rental income is falling.

From Whitney:

As this chart from the [NYT] article shows, it’s happening in nearly every major metro area…

That is, of course, the opposite of what you’d want if you were going to invest your money into building rental housing.

But Whitney is not deterred by this. He says:

At the risk of uttering the most dangerous words in finance, I would suggest that this time may in fact be different.

Rents are falling because renters still overwhelmingly live in apartments. According to a 2016 Harvard study, 61% of the US rental stock is multifamily (apartments), and only about 28% of rental properties are detached homes. (The remainder consists of attached homes, mobile homes, and RVs.)

Additionally, 46% of rental units are in cities, with 42% in suburbs and 12% in rural areas.

Moreover, notwithstanding the 30-year mortgage rate recently hitting 3% for the first time since July, rates still remain quite low on an absolute basis. Prior to July 2020, rates hadn’t been below 3% at any point in the 50 years people had been keeping track. Three percent is still a fantastic mortgage rate.

Whitney again:

I think this housing boom has legs and should be supportive of the homebuilders and building-products suppliers for several quarters to come. Many of the factors for a strong housing market – such as low interest rates, improving employment, and stable to improving consumer confidence – are firmly in place, and now a supply shortage has been layered on top of these macro factors.

So, what about all those buildings we have – that are now 90% vacant? What are we going to do with them?

I don’t know. My partners and I are having discussions about whether we should demand that all our employees return to their desks once the fear of the pandemic has abated. Some argue that we must, that physical proximity is the only way to optimize communication and to initiate new employees into the existing corporate culture. I don’t agree. I believe that many, if not most, of our employees have realized that there is no reason for them to commute to their jobs, and spend 8 or more hours inside a box inside a bigger box. They will want to continue to work as they have been working, from home or from a coffee shop or from a park. And I believe we will all work more efficiently with less physical contact.

What we do agree on is that we should let the CEOs that have been running these businesses successfully these past 12 months make their own decisions. And my guess is that will result in a decreased need for office space by at least 30%.

We are going to have to sit and see what happens for the rest of this year. In the meantime, I’m going to be thinking about converting some of that space into residential apartments!

MarkFord

MarkFord