Note: In response to numerous requests, I’m going to be touching on wealth building and investing every week, something I wrote about for years. I’m going to keep it short and simple. Two or three observations or ideas that (a) are not difficult to understand, (b) have obvious wealth-building implications, and (c) might help you avoid unnecessary financial losses and build your net worth carefully and steadily like I did for 40 years.

Clip of the Week: Buffett Is Hoarding Cash

Warren Buffett, generally considered the best stock investor of all time, is cashing in his stock in some of America’s biggest companies and moving into cash. According to Porter Stansberry, writing in The Big Secret on Wall Street, the total cash hoard is approaching $160 billion.

Buffett’s company, Berkshire Hathaway (BRKA), hit this record cash balance after selling off shares of three major American businesses, Proctor & Gamble (PG), Johnson & Johnson (JNJ), and General Motors (GM).

“Buffett purchased GM in 2012 shortly after it emerged from a government-engineered pseudo-bankruptcy. The unions were paid out about $0.90 of what they were owed, received a slew of preferred shares, and got board seats. The company’s creditors got robbed. They received about $0.10 on the dollar in newly issued equity that sat below the union’s preferred stock in the capital structure.

“Thus, today’s GM is a company born out of a crime. It’s since become a real-time litmus test of modern management theory – the idea that ‘diversity’ is an attribute in corporate boards.

“Today a majority of GM’s board members are women. I’d be willing to bet $100,000 that none of them can change the oil in their cars. Meanwhile, every member of GM’s board (according to the proxy statement) has expertise in ESG issues – the popular acronym for environmental, social, and governance. But only one board member (out of 13) has any automotive-industry experience – and that’s Jonathan McNeill.”

Continue reading Stansberry’s analysis here.

Chart of the Week: Will 2024 Be a Good Year for Stocks?

I’ve heard it said that the stock market does well during election years. I shy away from generalized observations like that because every time I have researched them in the past, the data doesn’t support the claim.

Yet, there is something about such very simple ideas that is attractive.

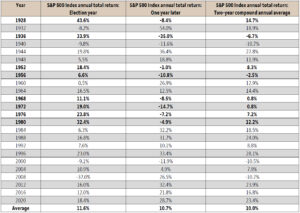

I found this chart from Wells Fargo. It shows that since 1928 the average return of the stock market has been 10%, while the average return in election years is 11.6%. That’s something. But now look at the range of returns for election years over time: from +43.6% to -37%!

Economic Craziness of the Week: Taxing Plastic Bags?

“Baltimore County, MD, is the first county in the state to implement a plastic bag tax at grocery and retail stores,” notes Garrett Baldwin in a recent installment of Postcards from the Florida Republic. “It’s not going over well. The radio hosts are complaining. The cashiers are apologizing.” (And Baldwin reminds us that Baltimore County is the same jurisdiction that enacted a “flush” tax not long ago to save Chesapeake Bay, with a $5 per month fee on sewer bills and a $60 a year fee for septic tank owners.)

The idea of a tax on plastic bags is to reduce the use of fossil fuels by forcing consumers to switch to reusable bags. (It’s estimated that about 12 million barrels of petroleum a year are used in the manufacture of plastic bags in the US.) But if it’s going to have any effect at all, it’s going to be minimal, experts say, because the petroleum used to make a half-ounce plastic bag is only a fraction of the petroleum used to produce the three to five pounds of purchased products those reusable bags usually contain.

In the same article, Baldwin mentioned a fact about oil and gas taxes that I’d never heard before. It helped me understand why federal, state, and even local governments like them so much. According to him, Maryland has a gas tax of 47 cents per gallon, 100% of which flows into the state coffers, while the oil industry, after locating, extracting, refining, and delivering that gas to Maryland, nets about 10 cents.

MarkFord

MarkFord