Clip of the Week: Loans from Uncle Warren

From Garrett Baldwin, writing in Postcards from the Florida Republic:

“Let’s talk about the Warren Buffett Closed-End Fund. A lot of people avoid closed-end funds because of their misunderstanding of risk. But let’s do a quick recap.

“Let’s say a money manager opens a new fund portfolio comprising stocks, bonds, or other investments. The manager sells a fixed number of shares on an exchange like the NYSE. Because it’s fixed, there will never be more shares issued. Investors buy the shares, which trade on a stock market like any other equity.

“But here’s the important part. Closed-end funds don’t trade like mutual funds and mirror their net asset value (NAV) at the end of the trading day. Instead, they are disconnected from their NAV. They trade irrationally. Sometimes, closed-end funds trade at a premium to the total fund’s net asset value.

“However, sometimes, they will trade at a discount. Imagine there’s a closed-end fund that trades at $18 per share. But the NAV may sit at $20. In this case, the fund trades at a 10% discount to its NAV…”

That could represent a very interesting opportunity… Continue reading here.

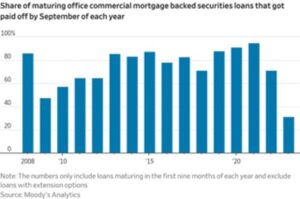

Chart of the Week: Office Rentals Are Getting Weaker

The office sector’s credit crunch is intensifying. By one measure, it’s now worse than during the 2008-09 global financial crisis. Only one out of every three securitized office mortgages that expired during the first nine months of 2023 was paid off by the end of September, according to

Moody’s Analytics. That is the smallest share for the first nine months of any year since at least 2008. The reason: Many office owners can’t pay back their old loans because they can’t get new mortgages. Click here.

Economic Craziness of the Week: Biden Administration Encourages Money Managers to Push ESG Investing

President Joe Biden’s Labor Department recently announced a new rule that will encourage money managers to put their clients’ money in what they call “environmental, social, and governance investing” (ESG). It allows them to ignore their fiduciary duties to provide their clients with the highest possible returns on their investments, based purely on financial and economic projections, in favor of funds that may be considerably weaker on the books, but have the “virtue” of being invested in companies that have high ratings in terms of social and environmental issues.

“Socially conscious investing has been around for decades,” says Stephen Moore, writing in a recent issue of Taki’s Magazine. “I have no problem with individual shareholders choosing to invest in such stocks. But it’s an entirely different matter when trillion-dollar investment and retirement funds such as BlackRock inject their own biases into the way they invest people’s savings without their knowledge or consent.

“To make matters worse, researchers at Columbia University and the London School of Economics found ESG funds may not even be achieving their goals. The study compared the ESG records of American companies in 147 ESG fund portfolios to ones in over 2,000 non-ESG portfolios and found that the ESG companies were often worse when it came to labor and environmental law compliance.”

MarkFord

MarkFord