Chart of the Week

This week, Sean provides a chart on US household spending that shows an uptrend in investment in stocks. The WSJ says it’s because it’s easier than ever to buy stocks. But Sean has a different and more alarming take…

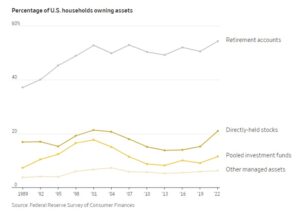

According to the Federal Reserve’s survey of consumer finances, more US households own stocks than ever before.

58% of Americans own stocks in their retirement accounts, while over 20% directly own them in taxable brokerage accounts.

According to The Wall Street Journal, this surge of stock ownership comes from “the elimination of commission fees,” which makes investing cheaper and easier than ever. Many brokerages now allow fractional trading as well, permitting individual investors to purchase a sliver of stocks like BRK.A with only a $1.

These theories are all fine and good. But I can actually read a chart.

When did previous spikes in stock ownership occur?

1998-2001, at the beginning of the dotcom collapse. 2007, right before the Great Recession. 2016, right before the Fed tightening cycle that led to a precipitous drop in 2018.

We’re just witnessing a tale as old as time: people chasing past returns. Plus a dash of asset inflation.

Another thing: Most of these assets are in retirement accounts. Retirement accounts, notoriously, do not offer many easy options to invest in besides stocks. This asset class, for the majority of Americans, is the only game in town.

But in late 2022, conditions looked right to begin investing in gold. Between that and my big tech recommendations, it paid off for my family and my readers.

Now I have my eyes set on a new non-stock asset class that I’ve been pouring money into for 2024. – Sean MacIntyre

Click here to find out the asset class that Sean says is moving “into the limelight.”

MarkFord

MarkFord