Newsom’s Magnificently Stupid Plan to Fill His State’s $68 Billion Budget Hole

Governor Newsom and California Democrats are once again “pioneering” an economic idea that is bound to fail.

I don’t know what Orwellian name they’ve coined for the bill, but it’s basically a wealth tax. A wealth tax is an annual excise tax on the worldwide wealth of taxpayers whose net worth exceeds a stated amount.

As is customary with taxing authorities, the wealth tax will be introduced in a way that won’t get great pushback, and then will become more severe after it’s established. In California, during stage one, it would apply only to billionaires, who would be taxed at 1.5% of their worldwide net worth. Few taxpayers will gripe about that, since there are fewer than 200 billionaires that live in California – a number that keeps getting smaller (there were 178 at the beginning of 2023, according to Forbes) because of wealthy Californians fleeing the state’s high taxes. (Not to mention its deteriorating government services, surging homelessness, a flood of illegal immigrants, and rising crime.)

If the bill passes, I’m willing to bet good money that we’ll see the population of California billionaires drop below 100 in the next few years solely because of the tax. And that’s not good. Not only will California lose the tax revenues of these emigres, it will lose thousands of jobs when some of them take their companies with them.

But that’s just the first stage. Come Jan. 1, 2026, the state would begin to impose a 1% wealth tax on all Californians, full- and part-time, whose net worth exceeds $50 million.

The bill, introduced last winter, is being discussed this week in the State Assembly. Its stated purpose is to raise billions in tax revenues to pay for a projected $68 billion budget deficit. If fully enacted, the wealth tax would raise an estimated $21.6 billion in revenue annually. A considerable sum, to be sure. But only about a third as big as the yearly deficit.

And that’s assuming no wealth exodus from the state. But the bill has a partial remedy for that. It includes a clause that would require Californians that leave the state to continue to pay the wealth tax years after they have established residency elsewhere.

To add teeth to the bill and get the support of lawyers, the bill would apply the state’s False Claims Act to wealth-tax records and statements. Which would mean that private attorneys could sue affluent individuals on behalf of the state for allegedly under-reporting assets – for which such attorneys would be entitled to a share of the state’s recovery.

In the meantime, California’s top effective marginal tax rate on wage income this year is increasing to 14.4% from 13.3%, owing to a new law that removes the $145,600 wage ceiling on a 1.1% state employee payroll tax to fund expanded paid family leave.

And the projected budget deficit of $68 billion will increase significantly as the state incorporates Newsom’s promise to give all of the state’s undocumented aliens free healthcare, education, and more.

They’ve tried wealth taxes in Europe in recent years, but it had the same effect there that I’m predicting it will have in California: a dramatic flight of the state’s highest taxpayers, including its largest employers.

And While We Are on the Topic of Fleeing Taxpayers…

Writing in the Albany Times Union, Chris Churchill reported that the US Census Bureau released end-of-year data on population swings and found that New York suffered another major decline. During the one-year period ending July 1, the state’s estimated population dropped by 101,000, making it the largest in the country in both total and percentage.

The good news, Churchill says, is that population outflow is expected to slow and perhaps even stop. The reason? “Higher mortgage rates are making Americans far less willing and able to move, even when they might otherwise want to.”

“So, there’s a little good news for you,” he says. “More New Yorkers will stay but not because they are happier with their state and lives. They’ll stay because they’re stuck.”

A Fun Example of the Willingness of Political Actors to “Spin” Facts in Their Favor

In mid-January, acting Secretary of Labor Julie Su told the press:

“The Bureau of Labor Statistics reported an increase in union membership, with 139,000 more union members in 2023 than in 2022, meaning this country has 400,000 more union workers than we had in 2021. The gains under the Biden-Harris administration underscore President Biden’s commitment to being the most pro-worker, pro-union president in history.”

But a glance at the full data reveals that the growth in nonunion jobs was considerably greater than the growth in unionized jobs – a fact that is contrary to the point Su was trying to make. To wit:

“The US Bureau of Labor Statistics said 10% of hourly and salaried workers were members of unions in 2023, or around 14.4 million people. That is an all-time low, down from 10.1% of workers in 2022.”

Chart of the Week

Today, Sean explains why, statistically speaking, 2024 is likely to be an up year for stocks. But that doesn’t mean he’s going to be adding to his stock portfolio. He tells you what he’s going to do below…

With interest rate cuts on the horizon, experts have made fairly positive forecasts for both stocks and bonds in 2024.

Economic data are presenting a number of warning signs. But historical trends in the stock market suggest something pretty straightforward:

The year will probably end with stocks having gone up.

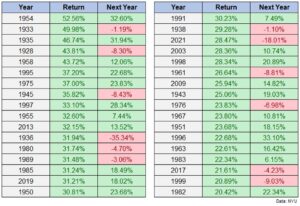

Since 1928, there have been 34 calendar years where the S&P 500 has finished up 20% or more against 26 total down years.

That means there are more “really good” years than “bad” years.

But what happens the year after a “really good” year?

Here’s a summary from A Wealth of Common Sense:

* The stock market was up 22 out of the 34 years following a 20% gain (65% of the time).

* The stock market was down 12 out of the 34 years following a 20% gain (35% of the time).

* The average return following a 20% up year was +8.9%.

* The average gain was +18.8% in up years.

* The average loss was -9.1% in down years.

* There were just two double-digit down years following a +20% year (1936 and 2022).

Simply put: The historical odds are in our favor to see the market rise in 2024.

Now, will that be a steady rise? Will stocks crash and recover, as they’ve done in the past? Will returns be exceptional or humdrum?

The uncertainty around these questions has led me to prefer bonds over stocks in 2024.

– Sean MacIntyre

Click here to see a brief explanation of Sean’s reasoning.

MarkFord

MarkFord