David Hockney

David Hockney has one of the most distinguished and impressive careers of any still-living artist I know of. He was recognized as an up-and-coming master by the time he turned twenty (in 1957) and his reputation as an important modern artist has not diminished since then.

That’s nearly 70 years. And he’s still making art. And not just reproductions of what he did at his creative apex (like Picasso, for example) but art that, for me at least, rivals anything the younger artists, working with digital technology, are producing today.

He was born in Bradford, England in 1937, the fourth of five kids raised by a Methodist mother and a pacifist father who’d been a conscientious objector during World War II. Like so many great artists before him, Hockney’s talent for art was evident in his childhood. And like those same artists before him, he did his university-level studying at a great school of art – in his case, the Royal College of Art in London.

It’s not surprising, considering that he was at the Royal College during the late 40s and early 50s, that he became friends with a crowd of other young artists who were intent on taking art forward in some way. In their case, it was the British pop art movement.

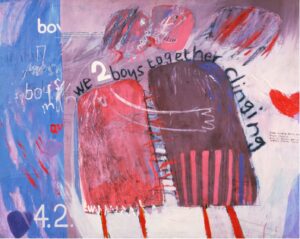

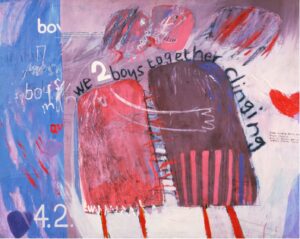

Although Hockney respected and encouraged his friends and their ambitions, his own early work was very different – more experimental and expressionistic.

This one, titled We Two Boys Clinging, is said to reflect both the poetry of Walt Whitman and Hockney’s own “emerging homosexual identity.”

I don’t see that. I see the influence of Philip Guston:

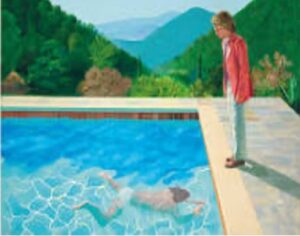

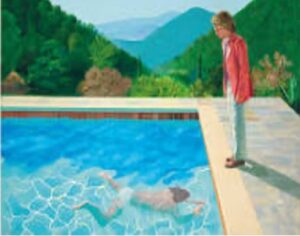

In 1964, Hockney moved to Los Angeles, where he developed the first of many “signature” styles. The first one had a lot to do with swimming pools, clean, horizontal lines, and a spectrum of pastel reds and blues – e.g., A Bigger Splash and Portrait of an Artist (Pool with Two Figures):

(By the way, Portrait of an Artist became the most expensive work by a living artist when it sold for $90 million at Christie’s in 2018. But the record didn’t last long. In 2019, Jeff Koons reclaimed the title with Rabbit, which sold for $91 million.)

These works by Hockney remind me of some of Edward Hopper’s paintings – like this one, Room by the Sea:

Images of swimming pools and sun-soaked scenes kept Hockney’s interest for several years while he lived in LA. Soon, however he was moving on.

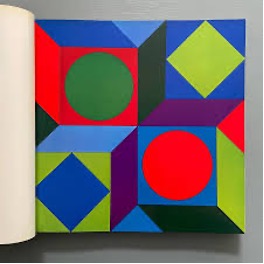

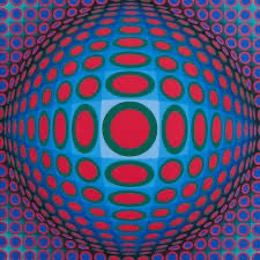

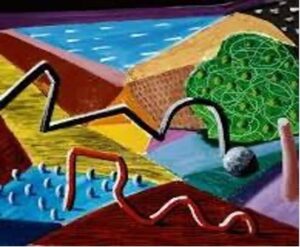

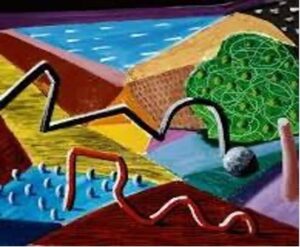

During the 1980s, Hockney had a new “signature” style. It retained the vibrancy of his early Expressionism, but with additional distinctive colors added to the palette he had been relying on for more than 20 years. Most noticeably, these paintings employed perspective and structure. I don’t see how you could not say that, in creating yet another “distinctive style,” Hockney was also creating his own distinct brand of Surrealism.

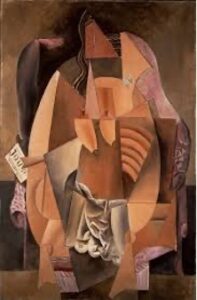

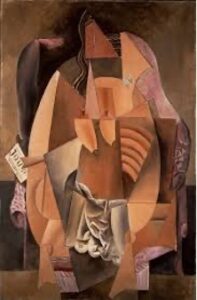

Again, I find these works to be – not derivative, by any means, but reminiscent of some of the great established modernists of the time.

Throughout his career, Hockney kept reinventing himself, moving from painting to printmaking, photography, and digital art.

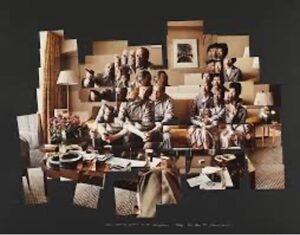

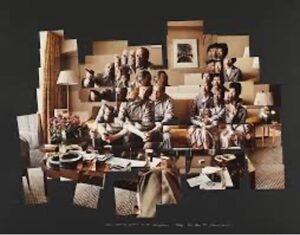

Also in the 1980s, he began creating “joiners” – photo collages made from hundreds of Polaroids or 35mm prints, which he arranged to give a Cubist-like sense of time and movement.

It goes without saying that these pieces are reminiscent of some of the Cubist paintings by Picasso and Braque.

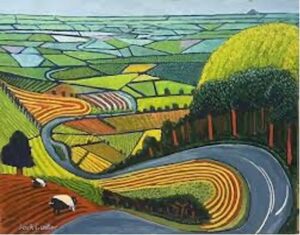

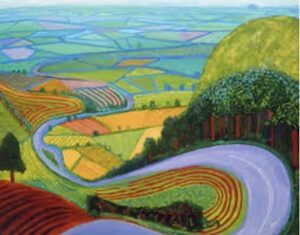

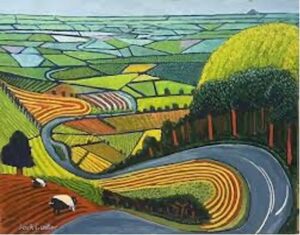

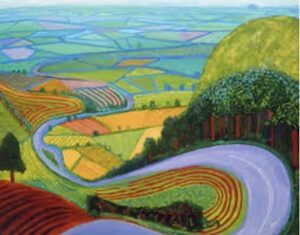

By the late 1990s, Hockney was spending more time in Yorkshire, his childhood home, where he began painting landscapes again. These works, like those of Garrowby Hill, below, were massive, made up of dozens of smaller canvases that combined to create sweeping panoramas.

These, too, remind me of another great modern artist – perhaps someone who was painting in the 1990s and early 2000s. But for the moment, I can’t remember the name.

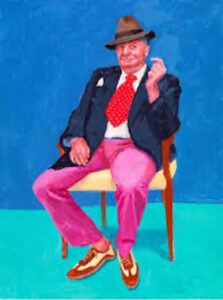

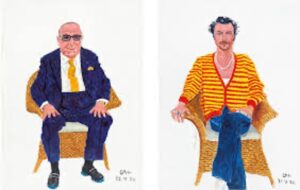

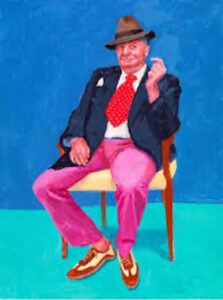

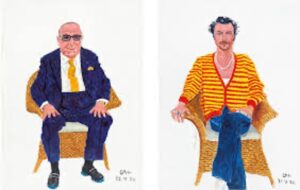

So far, I’ve said nothing about Hockney as a portrait artist. In that regard he is second to none. His subjects included friends, family, and acquaintances, as well as people we might recognize.

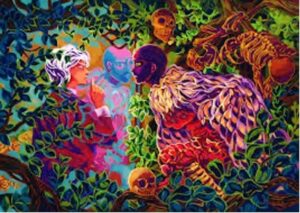

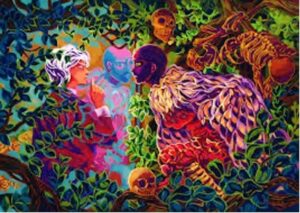

As the new millennium opened, Hockney was not going to allow his art to be a thing of the past. He began experimenting with new technology, including fax machines, photocopiers, and eventually iPads.

These are not single canvases but assemblages of as many as 60 individual images he created. We saw this one at the Fondation Louis Vuitton exhibition. (See “My Journal,” above.) It was amazing!

And what artist does this work remind you of?

In 2018, he even designed a stained-glass window for Westminster Abbey using an iPad.

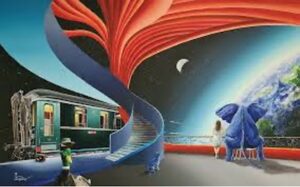

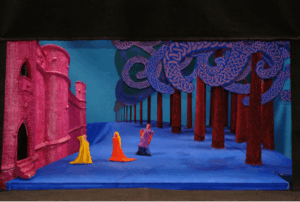

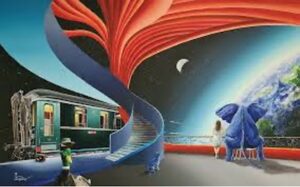

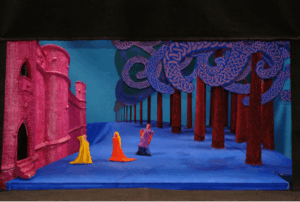

Hockney also produced some amazing theatrical pieces, huge, beautiful backdrops for well-known plays. We got to see several of these at the exhibition.

And finally, in very recent years he’s produced some amazing, animated art works, which we also saw.

Hockney’s personal life has been as colorful as his art. He’s been openly gay since his student days and had several long-term relationships with men who became the subjects of his work, including Peter Schlesinger and Gregory Evans. His current partner, JP, works as his chief assistant. Hockney still paints every day, often using digital tools, and despite some health challenges – including hearing loss – he remains as prolific and inventive as ever.

From classic Pop Art to iPad landscapes, from LA pools to Yorkshire fields, Hockney’s work is a kaleidoscope of color, humor, and the sense of wonder that keeps him painting well into his 80s.

You can read a review of the show at the Fondation Louis Vuitton here.

And you can watch a 5-minute video about it here.