The 12-Day War (or Whatever It Was)

What the hell just happened?

Did the US military just bomb the hell out of Iran? Did it really fly thousands of miles over the ocean and then over Eastern Europe and then into and over Iran air space, undetected, and then drop “bunker buster” bombs on all of Iran’s major nuclear power facilities? Did it destroy them, as Trump claimed? Or does the Ayatollah and his war machine have “plenty more of that [enriched uranium]” hidden in some remote location we failed to hit?

And what the hell is going to happen now?

Will Iran launch a counterattack? Will it bomb US facilities in and around the Persian Gulf? Will other Arab countries get behind Iran and turn this now three-country conflict into a regional war? Or worse yet, will Russia and China, whose interests are tied up strongly with Iran, get involved? Are we talking about WWIII?

If Trump is right about how much damage was done, will Iranians give up (at least for now) their hopes of becoming a nuclear power? And if they do, would they consider talking peace with Israel? Would they consider, seriously for the first time in 40+ years, suspending their crusade to wipe Israel off the face of the Earth?

Let’s Look at the Pieces, One at a Time

Here are the questions that popped up in my mind the moment I decided to take a crack at writing about this. I’m sure they are the same questions that a thousand (10,000? 100,000?) online bloggers are asking themselves right now:

* What, exactly, happened?

* What was the goal?

* What was the rationale?

* To what degree was it achieved?

* What was the global reaction?

And as a headline in The Free Press asked:

Did Trump just start a war or end one?

I am conscious that this will be read by many of my colleagues, friends, business associates, and especially members of various discussion groups I belong to – each of whom has intellectual prejudices related to this conflict that they are unlikely to be swayed away from by anything I say. (I can already hear them shouting at me, telling me what I should think!)

A Full Range of Ideological Biases and Predispositions

My Anarchist/Capitalist and Libertarian heroes have roundly denounced the bombings. They long ago figured out that war is always bad for freedom and the economy and is usually the result, as Hemingway noticed, of screwing around with the national currency.

My Liberal and Leftist friends that hate Donald Trump and are also antisemitic (as the majority of them are) are appalled by the bombings and have no doubt that this is another example of Trump thinking he’s a King and acting like a Dictator.

My Liberal and Leftist friends who hate Trump but think of themselves as fair-minded about the Arab/Israeli conflict and/or sympathetic towards Israel are confused. The hate-Trump part of their brains wants to hate the bombings. But another part – the part that understands that Iran is the largest sponsor of pro-Hamas/anti-Israel terrorism in the world – is secretly happy about the bombing and hopes it may remove from Iran the possibility of developing a nuclear weapon.

I don’t have any Neocon friends (or perhaps I do, but they know better than to let me know). These people are very happy with the bombings and are hoping to see much more of that sort of thing all over the Middle East and Eastern Europe.

Maybe it’s best to begin with stating something that everyone reading this will agree with: The bombing of Iran was a big thing. And it’s almost certainly going to have big consequences. The only question is: What sort of consequences? And how many?

Things were spicy hot around the globe before the bombing took place. Russia’s invasion of Ukraine in 2022 was already, under the Biden administration, another proxy war between the US and Russia. And when Israel defended itself after the Oct. 7, 2023 massacre of 344 Israeli civilians, and then began its attack on Iran, the tension was at a breaking point.

Now, with the US moving into the conflict actively, many media personalities, Foreign Relations analysts, and Cold War pundits are writing and speaking about the possible repercussions.

I’m neck-deep in reading what those guys have to say. But I’m finding very little in the press from the leaders of countries that have a stake in what just happened. I’ll try to figure out why they’ve been surprisingly quiet later in this essay. Meanwhile, let’s try to answer the first question: What, exactly, happened?

Some of the Relevant Facts

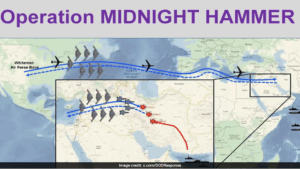

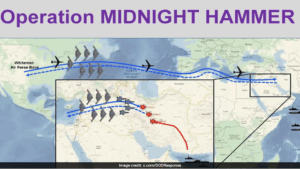

Last weekend, the US launched a precision strike targeting key Iranian nuclear sites – mainly facilities believed to be involved in developing nuclear weapons and long-range missiles. According to officials, the operation was planned months in advance, likely involving a mix of satellite imagery, signals intelligence, and possibly cyber operations.

Reports said cruise missiles and drones were used to hit specific underground bunkers and storage depots – places where Iran has been known to hide and protect sensitive material. Early assessments from US and Israeli sources claimed the attack caused significant damage, possibly delaying Iran’s progress by several months, if not longer.

Iran’s government immediately condemned the attack, calling it an act of war and promising retaliation.

Iran has been working relentlessly to develop nuclear weapons for years. It’s also been building up a missile arsenal capable of reaching Israel and potentially Europe and US interests.

According to US intelligence sources, Iran’s underground nuclear facilities – like the Fordow plant – are heavily fortified and dispersed. That makes them tough targets, but the US use of the GBU-57 Massive Ordnance Penetrator (MOP) bomb, which can penetrate 100 feet into the ground or into 20 feet of reinforced concrete, can, in theory at least, reach and destroy them.

If It Were Only That Simple

Iran has a history of secretly hiding and moving nuclear materials, and intelligence analysts suggest they’ve already taken steps to preserve their capabilities. Some leaks indicate that they might have already managed to transfer or hide key components, meaning this strike could have been a temporary setback rather than a knockout punch.

So, if you ask me, Operation Midnight Hammer was a targeted operation designed to delay Iran’s nuclear breakout – and it was probably the best shot we had right now.

But let’s be real. Iran’s regime remains deeply committed to its goal: developing nuclear weapons and ICBMs to attack and eventually destroy Israel and the US, and after that to convert or slaughter the rest of the non-Islamic peoples.

Why Did Trump Decide to Bomb Iran?

Trump had been saying, long before he took office, that Iran should not be allowed to develop a nuclear weapon. During his first and second campaigns, he said it again, repeatedly, and chastised previous administrations for not taking aggressive action to stop it from happening.

Iran has long claimed its nuclear program is peaceful, but that’s nonsense. For peaceful purposes, uranium enrichment only needs to be in the single digits, and Iran has enriched uranium up to 60%. Apparently, that’s where you want to keep it until you are ready to use it because it’s more stable there, but it can be upgraded to 80% quickly and easily.

Iran’s regime has a proven history of threatening Israel with annihilation, along with ongoing missile development and regional destabilization. And intelligence leaks and reports from sources close to the Trump administration indicate that Iran has been clandestinely moving nuclear materials and deploying advanced centrifuges, despite their public claims of peaceful energy development. Meanwhile, many analysts believe – and I can’t see why they wouldn’t – that Iran regards nuclear weapons as its ultimate deterrent. Which is why they have spent so much money over so many years building out that capability while insisting they are creating fuel for peaceful reasons.

So, the declared reason for the US strike – which I think is 100% accurate – was the intention to prevent the Iranian regime from acquiring a nuclear bomb. And that striking now gave the US a good chance to at least set back its development by decades and possibly get the regime to accept a non-development agreement.

I think Trump and his team were right in thinking that, as risky as the bombing decision was, continuing to ignore Iran’s relentless and undeniable progress in developing nuclear war capability would have been riskier.

Has the Bombing Destroyed (or at Least Impeded) Iran’s Plan to Develop Nukes?

This is the million-dollar question.

Everyone seems to agree that Iran’s most critical nuclear facilities are deeply underground, built within fortified mountains and designed explicitly to withstand conventional bombs.

Israel doesn’t have the bombing capability to reach those sites, but the US does. In the US surprise attack last weekend, stealth bombers flew thousands of miles into the region and then over Iran to deliver GBU-57 bombs that are specifically designed to destroy hidden, hardened underground bunkers.

It’s very probable that they caused significant damage, potentially crippling or even destroying Iran’s underground enrichment and storage capabilities.

However, Iran is supposedly notorious for its secrecy and clandestine activities. Intelligence agencies around the world believe that Iran has constructed multiple, equally fortified sites that are either undiscovered, disguised, or located in remote areas, especially in the mountainous regions along the border with Pakistan and Afghanistan.

Reports on the Success of the Strike from On High

Trump has said, several times, that the mission was “a great success” and that Iran’s nuclear option has been completely destroyed.

Others are saying that no one but the Iranians has any idea if that’s true, because they have a long history of moving and hiding their development sites, and there is no reason to think that they haven’t done that in recent months.

That’s what Deputy Secretary of State Wendy Sherman seemed to be referring to when she said that the attacks were meant to “destroy what we could find” and to “send a message” that Iran’s nuclear ambitions won’t go unanswered. Former Defense Secretary Mark Esper said the goal was “to damage Iran’s underground facilities enough to force them to slow their program or reconsider their progress.” And Benjamin Netanyahu and other Israeli leaders said that the strike was successful in causing “significant damage” to “key parts of Iran’s underground program.

So, guess what? Trump is exaggerating. He’s overstating the case – maybe because he can’t stop himself. But his team is saying that the bombings, even if they didn’t hit all the sites, were successful in severely damaging Iran’s ability to build a nuke any time soon.

The Logic

Still, I don’t see any advantage in Trump’s team or Israeli officials saying that the US military had “largely” completed its mission if it hadn’t. If they are lying, what do they accomplish? A few weeks or months of patting themselves on the back before we discover the truth?

Assuming that the sites were at least damaged sufficiently to postpone any thoughts Iran had about becoming a nuclear power in the near future, what they have to focus on right now is the continuing military attacks coming from Israel.

From Israel’s point of view, the US has given them the one thing they would need to get Iran to come to the bargaining table and discuss not just disarmament but some sort of promise to stop funding Hamas and Hezbollah and all its other anti-Israel proxies. Or, if Netanyahu thinks that will never happen, to crank up his attacks on the country’s military infrastructure until it is completely destroyed.

Iran has to see that as a distinct possibility. A risk it would be foolish – no, insane – to take right now. There’s no doubt that the US bombings have only hardened their commitment to wiping Israel and the US from the face of the Earth, but they are not going to have any chance of doing that if they don’t persuade the rest of the world that they have seen the light and will sign a non-development deal.

For 40 years, Iran’s leaders have shown that they’re willing to bide their time, hide their true activities, and push forward behind a fog of deception. But at this point in time, at this stage of the war’s escalation, will the Ayatollah and his advisors take the rational path? Or will they pray to their God for courage and do what the Koran demands of them?

Bottom line: Iran’s long game is still very much alive. What they do next will depend on how much external pressure they face.

Reaction to the Strike from the Rest of the World

The reaction from the rest of the world? It’s been surprisingly muted, but that’s probably more telling than a loud outcry.

Most Arab countries, especially Sunni Gulf states like Saudi Arabia and the UAE, have historically been wary of Iran’s regional ambitions. But right now, they seem more concerned with how this might spiral out of control than about Iran’s nuclear threat.

Saudi Crown Prince Mohammed bin Salman warned that escalation “could destabilize the entire region,” and many Gulf state leaders are quietly preparing for possible fallout – though they’re not openly condemning the strike.

Turkey’s response was cautious. President Erdogan called for “restraint and dialogue,” aware that Turkey’s own interests lie somewhere between balancing its fragile alliance with the West and its extensive trade relationship with Iran. As one Turkish official put it, “We want stability in the region, not another war,” but everyone is clearly wary of letting things get out of hand.

And then there was the response – or lack thereof – from Russia and China.

Russia has been openly opposing America’s moves and backing Iran as part of their broader push to challenge Western dominance. And yet the response from Foreign Minister Sergei Lavrov was understated. He said the attack “undermines regional stability” and that “military solutions will not resolve the core issues.” And Chinese authorities have urged “all parties to exercise restraint.”

That a little confusing because there are good reasons why China and Russia are allied with Iran in this conflict.

From an economic and political perspective, both nations should be in Iran’s corner. Russia benefits from Iran’s oil and military cooperation. And China profits from trade, including oil and infrastructure deals under the Belt and Road Initiative.

Politically, both superpowers see Iran as a resource in countering Western sanctions, influencing Middle Eastern stability, and reducing US leverage in the region. Supporting Iran allows Russia and China to push back against US efforts to isolate Tehran and assert their own regional and global power.

So, why such soft responses?

It could be because Russia, China, and even many Muslim countries in the region understand that they benefit from regional stability and are hyper-aware that that this conflict could escalate into full-blown confrontation – especially when the wild and unpredictable Trump card is on the table.

So, What Am I Saying?

If it feels like I’m landing this essay in limbo, it’s not on purpose. The stakes are high. The momentum is increasing. The principal players are unpredictable.

The decision to bomb Iran’s nuclear facilities was a decisive move. We can only assume that there is a good chance that Iran will respond. And an equally good chance that the US and Israel are planning on it.

I think that Russia, China, and most of the Muslim countries that are “on Iran’s side” will sit this one out. That gives Iran the choice of fighting the US and Israel on its own or finding some way to capitulate with some degree of dignity.

I have to believe that Trump and Netanyahu would be very happy with that outcome, but I’m guessing that the Ayatollah will not be willing to make them happy. And if that’s so, the future – our future – will depend on whether he’s really the Supreme Leader.

Sources

The Free Press, “Did Iran Just Sneak Out Critical Nuclear Materials?”

The Free Press, Matti Friedman on Iran’s nuclear capabilities post-strike

The Free Press, “Trump Keeps His Promise on Iran”

The Free Press, Albert Eisenberg on murders by Iran and US involvement

The Wall Street Journal on Trump’s approach to Iran and its implications

Other sources include official statements and analyses from:

* Former Secretary of State Mike Pompeo, public speeches and interviews regarding Iran’s nuclear ambitions

* Dr. David Albright, Institute for Science and International Security, analysis of Iran’s underground nuclear facilities

* Former CIA Director Michael Hayden, various public comments on Iran’s clandestine capabilities