The Supply Crunch in Luxury Homes

The difference between a mortgage rate of 3%, where rates were four years ago, and 5.5%, where they are today, can make a significant difference in the monthly mortgage payment for middle-income buyers. Many are not able to buy homes they could have bought four years ago. So, they have a choice: Buy less of a house. Or don’t buy at all.

For high-income home buyers, that sort of interest-rate differential is not significant, and the demand for luxury homes is still strong. The problem, says California realtor Ken DeLeon, is that “the lack of supply almost perpetuates the lack of supply because sellers don’t have anywhere to go.” (Since 2000, the average monthly number of active existing-home listings has dropped 45%, according to a recent report.)

If you are interested, you can read more here.

A Different Kind of Dumb: How the US Sabotaged Itself in 1992

In this concise and amusing little essay, Bill Bonner explains how, in 1992, the US stood on top of the globe, with the world’s largest and strongest economy, a relatively happy and productive workforce, a strong dollar and a vibrant stock market, and what looked like the beginning of a new era of world peace.

But then…

Click here to enjoy Bill’s summary of how we F-ed it up.

Chart of the Week: The Speed of Compounding

When our nieces and nephews were young, K and I opened accounts for them. We deposited an amount of money that was not great, but enough so that if they wanted to, they could have used it to buy a late-model used car. However, we told them that we didn’t want them to spend it. We wanted them to save it. If they did, we explained, they would end up with a lotta, lotta money that they could use to add to the enjoyment of their lives when they retired.

This week, Sean gives us several charts that explain the “miracle” of compound interest. What happens, as you can see, is that it begins steadily and slowly. But then, after 20 and 30 years, it ascends steeply. The end numbers are truly mind-blowing. – MF

Most people reading this have heard about the power of compound interest.

Compounding is a simple investment strategy in which you put your money in an investment that pays a cash return, such as a dividend.

You then take your cash return and reinvest it. Your reinvested dividend, or interest, then earns a return, too.

For a comparison, think about a snowball. As you roll the ball through the snow, the surface area gets bigger. The more surface area on the snowball, the more snow it picks up. The snowball gains mass slowly at first… but pretty soon, it’s so large you can’t stop it from rolling.

Now, you have probably heard that analogy before. But I don’t think it drives home just how crazy it gets when you’re able to compound wealth over a long period of time.

Because in reality, compounding does more than cause money to grow. It also causes the time you need to make money to shrink!

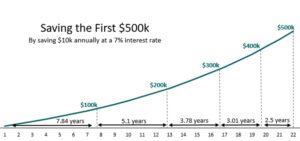

Imagine saving $10,000 every year and earning 7% compound interest.

The blog Four Pillar Freedom provides an exceptional chart of how this looks in action.

It will take you 7.84 years to crack the $100,000 level this way.

A long time!

But look what happens next…

With the same investment and interest rate, it only takes 5.1 years to get the next $100,000.

Over time, the gap between $100,000 increments becomes shorter and shorter.

Although you’re still investing $10,000 per year, the money you’ve already saved has continued to compound.

By the time you’re going from $400,000 to $500,000, it only takes 2.5 years.

If you crunch the numbers, it takes more time (7.84 years) to go from $0 to $100,000 than it does to go from $600,000 to $1 million (6.37 years).

Isn’t that incredible?

That’s the hidden power of compounding.

Compounding does more than generate money faster and faster.

Compounding actually buys you more and more time the longer you take advantage of it.

This chart also shows why Charlie Munger was so adamant about scrimping and saving to get to your first $100,000 invested…

Because after that? It’s when compounding kicks into full gear, and your wealth goes crazy.

But the key to get there, as with most things, is consistency.

If you haven’t been putting aside any money before, now’s the second-best time to get started.

– Sean MacIntyre

Click here for a great video lesson on investing from Sean.

And check out his YouTube channel here.

MarkFord

MarkFord